Management Analysis Of Financial Position, Operating Results, And Cash Flows

OPERATING RESULTS

① Overall business conditions

In 2024, the environment surrounding the company has changed at an accelerating pace, with major economic and social consequences. Globally, conflicts and disputes among major powers have further heightened geopolitical tensions. Economically, the situation remains uncertain despite the calming of inflation, especially in the U.S., and the gradual recovery of the domestic economy.

In addition, environmental measures are urgently needed due to the frequency of extreme weather events and disasters in many countries around the world. In the digital ICT field, the practical application of generative AI and quantum technology is accelerating and having a significant impact on industries, labor markets, and ways of working.

As the social environment undergoes major changes and becomes more complex, consumers’ values and lifestyles are becoming more diverse than ever before, and we are entering an era of great change in which conventional wisdom is no longer applicable.

With “Creating Shared Value (CSV)” at the core of its management, the Kirin Group aims to achieve sustainable growth by flexibly responding to drastic changes in the business environment through its unique business portfolio management, which includes health science in addition to alcoholic beverages, non-alcoholic beverages, and pharmaceuticals.

In 2024, in order to further evolve CSV management and increase the degree of strategy execution in each business, we shifted to a new management structure with two members, CEO and COO, and worked to maximize corporate value.

We were successful in growing business profit in the alcoholic and non-alcoholic beverages business, strengthening the global foundation of the pharmaceuticals business, and expanding the scale of the health science business in line with the Kirin Group 2022-2024 Medium-Term Business Plan (2022-2024 MTBP). We achieved a record-high normalized operating profit, which is an indicator that measures the ongoing performance of a business. However, net profit attributable to owners of the Company decreased due to decisions made to lay the foundations for business growth, such as the loss on step acquisition associated with the consolidation of FANCL Corporation and the loss on transfer of the amino acid and other businesses of Kyowa Hakko Bio Co., Ltd. In terms of ESG initiatives, we have received high praise from external organizations, and for the fourth consecutive year, we have received an “AA” rating in the MSCI ESG Rating, an ESG index, on par with leading global companies in CSV management.

Kirin Holdings was also selected as one of the SX Brands (Sustainability Transformation Brands) 2024 initiated by Japan’s Ministry of Economy, Trade and Industry and the Tokyo Stock Exchange.

In addition, Kirin Holdings received the highest overall ranking for SDGs Management in the 6th Nikkei SDGs Management Survey for the sixth year in a row. Kirin Holdings’ efforts to address social issues through its business operations and information disclosure of natural capital initiatives were highly praised.

(¥ billions, unless otherwise stated)

| FY2024 | FY2023 | Change | ||

|---|---|---|---|---|

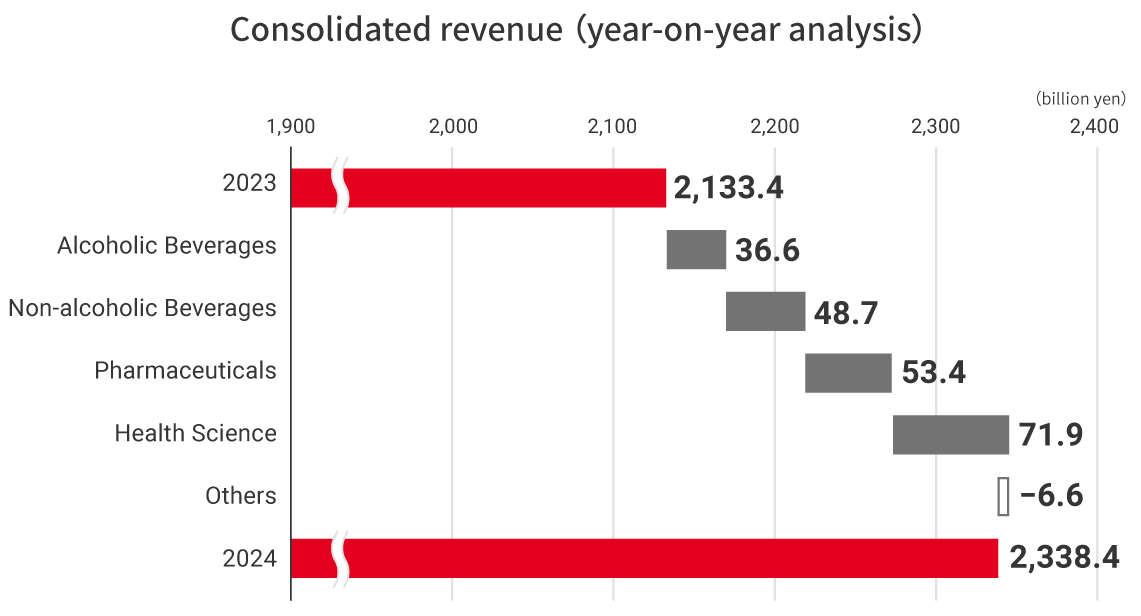

| Consolidated revenue | 2,338.4 | 2,134.4 | 204.0 | 9.6% |

| Consolidated normalized operating profit | 211.0 | 201.5 | 9.5 | 4.7% |

| Consolidated operating profit | 125.3 | 150.3 | (25.0) | (16.6)% |

| Consolidated profit before tax | 139.7 | 197.0 | (57.3) | (29.1)% |

| Profit attributable to owners of the Company | 58.2 | 112.7 | (54.5) | (48.3)% |

(Key performance indicators)

| FY2024 | FY2023 | Change | ||

|---|---|---|---|---|

| ROIC | 4.1% | 8.0% | ― | ― |

| Normalized EPS (yen) | 172 | 177 | (5) | (2.8)% |

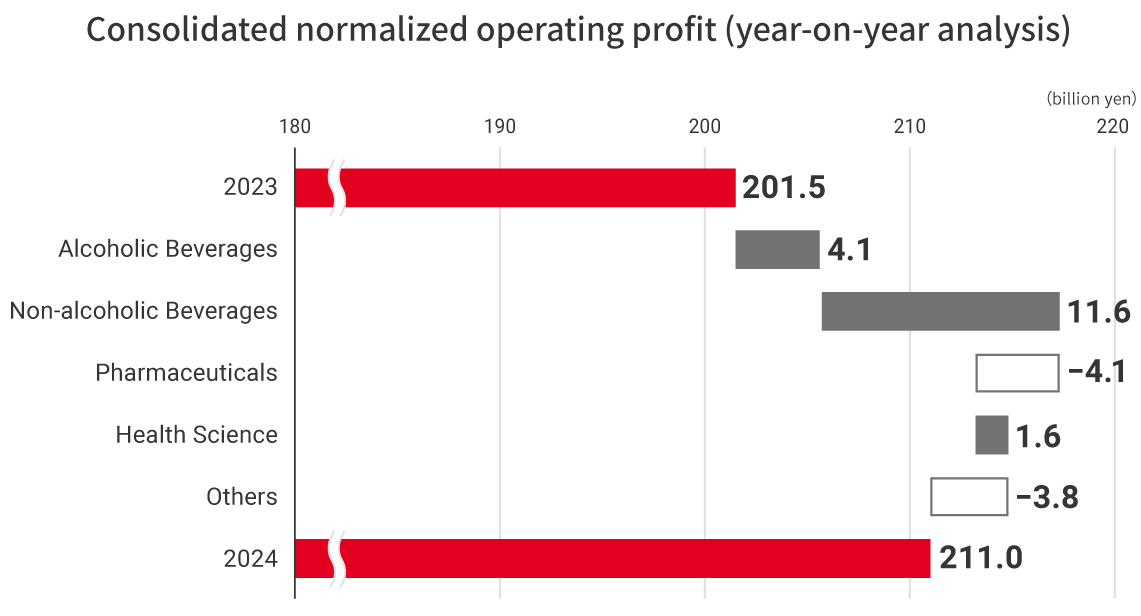

Consolidated revenue for the fiscal year 2024 increased due to increases in sales of the Alcoholic Beverages Businesses, the Non-alcoholic Beverages Business, the Pharmaceuticals Business, and the Health Science Business. The Pharmaceuticals Business posted a decrease in profits, but the Alcoholic Beverages Businesses, the Non-alcoholic Beverages Business, and the Health Science Business saw an increase in profits, resulting in an overall increase in consolidated normalized operating profit. However, net profit attributable to owners of the Company decreased due to decisions made to lay the foundations for business growth, such as the loss on step acquisition associated with the consolidation of FANCL Corporation and the loss on transfer of the amino acid and other businesses of Kyowa Hakko Bio Co., Ltd.

Among the key performance indicators, ROIC was 4.1% due to an increase in debt from growth investments in the Health Science Business and the Pharmaceuticals Business and a decrease in profit. Normalized EPS decreased by 5 yen from the previous fiscal year to 172 yen.

② Performance by reportable segment

Results by segment are as follows.

(¥ billions, unless otherwise stated)

| FY2024 | FY2023 | Change | ||

|---|---|---|---|---|

| Consolidated revenue | 2,338.4 | 2,134.4 | 204.0 | 9.6% |

| Alcoholic Beverages | 1,081.7 | 1,045.1 | 36.6 | 3.5% |

| Non-alcoholic Beverages | 564.9 | 516.2 | 48.7 | 9.4% |

| Pharmaceuticals | 495.3 | 441.9 | 53.4 | 12.1% |

| Health Science | 175.3 | 103.4 | 71.9 | 69.6% |

| Others | 21.3 | 27.8 | (6.6) | (23.6)% |

| Consolidated normalized operating profit | 211.0 | 201.5 | 9.5 | 4.7% |

| Alcoholic Beverages | 124.0 | 119.9 | 4.1 | 3.4% |

| Non-alcoholic Beverages | 64.0 | 52.4 | 11.6 | 22.2% |

| Pharmaceuticals | 91.9 | 96.0 | (4.1) | (4.3)% |

| Health Science | (10.9) | (12.5) | 1.6 | ― |

| Others | (58.0) | (54.2) | (3.8) | ― |

FINANCIAL POSITION

① General overview

Total assets at the end of the fiscal year 2024 were ¥3,354.2 billion, an increase of ¥484.6 billion from the end of the previous fiscal year. Property, plant and equipment, goodwill, and intangible assets increased by ¥548.0 billion in total from the end of the previous year. This was primarily due to the impact of the consolidation of FANCL Corporation.

Equity increased by ¥107.9 billion from the end of the previous fiscal year to ¥1,533.7 billion due to an increase in reserves of ¥57.9 billion and an increase in non-controlling interests of ¥58.9 billion. The increase in reserves was mainly attributable to an increase in foreign currency translation differences on foreign operations of ¥54.6 billion due to a weak yen. The increase in noncontrolling interests was mainly attributable to the impact of consolidation of FANCL Corporation.

Liabilities increased by ¥376.7 billion from the end of the previous fiscal year to ¥1,820.4 billion. Bonds and borrowings increased by ¥201.2 billion mainly due to new borrowings. Deferred tax liabilities increased by ¥84.3 billion due to the impact of the consolidation of FANCL Corporation.

As a result, the equity ratio attributable to owners of the Company and the gross debt equity ratio stood at 35.2% and 0.73 times, respectively.

② Financial status of reportable segments

Alcoholic Beverages Business

Segment assets of the Alcoholic Beverages Business at the end of the fiscal year 2024 increased by ¥20.9 billion to ¥1,367.5 billion from the end of the previous fiscal year mainly due to an increase in inventories.

Non-alcoholic Beverages Business

Segment assets of the Non-alcoholic Beverages Business at the end of the fiscal year 2024 increased by ¥38.9 billion to ¥326.4 billion from the end of the previous fiscal year mainly due to an increase in property, plant and equipment as a result of capital expenditures.

Pharmaceuticals Business

Segment assets of the Pharmaceuticals Business at the end of the fiscal year 2024 increased by ¥41.3 billion to ¥1,012.7 billion from the end of the previous fiscal year mainly due to an increase in intangible assets of goodwill, marketing rights, and in-process research and development expenses.

Health Science Business

Segment assets of the Health Science Business at the end of the fiscal year 2024 increased by ¥290.4 billion to ¥764.1 billion from the end of the previous fiscal year mainly due to an increase in intangible assets resulting from the consolidation of FANCL Corporation.

CASH FLOWS

① Cash flows and liquidity status

The balance of cash and cash equivalents (hereinafter, “net cash”) at the end of the fiscal year 2024 was ¥118.6 billion, a decrease of ¥12.8 billion from the end of the previous fiscal year. Cash flows for each activity were as follows:

Cash flows from operating activities

Net cash provided by operating activities increased by ¥39.6 billion year on year to ¥242.8 billion. Although impairment loss, which is a noncash item, decreased by ¥16.6 billion, a ¥18.3 billion loss on step acquisition, a ¥19.3 billion impairment loss on equity-accounted investments, and a ¥15.5 billion decrease from the absence of gains on sales of equity-accounted investments that were recorded in the previous year, as well as a ¥2.4 billion decrease in outflow of working capital, resulted in an increase of ¥45.9 billion in the sub-total. Below the sub-total line, cash flows from operating activities increased year on year despite a ¥14.2 billion increase in income taxes paid.

Cash flows from investing activities

Net cash used in investing activities increased by ¥103.3 billion year on year to ¥329.4 billion. Net cash provided by investing activities for the fiscal year 2024 included ¥7.4 billion in proceeds from sale of investments through our continuous efforts to reduce cross-shareholdings and ¥1.3 billion in proceeds from sale of shares of subsidiaries. The increase in net cash used in investing activities year on year was mainly due to a ¥66.8 billion increase in expenditures for the acquisition of property, plant and equipment and intangible assets to ¥180.6 billion, and a ¥20.5 billion decrease in proceeds from sale of equity-accounted investments. The acquisition of shares of subsidiaries decreased by ¥2.3 billion year on year to ¥159.8 billion, due to the consolidation of Orchard Therapeutics Limited and FANCL Corporation in the fiscal year 2024 and Blackmores Limited in the same period of the previous fiscal year.

Cash flows from financing activities

Net cash from financing activities increased by ¥22.2 billion year on year to ¥58.1 billion. This was mainly due to an increase in interest-bearing liabilities by ¥74.6 billion year on year to ¥200.8 billion as a result of the consolidation of FANCL Corporation and an increase in acquisition of treasury shares of subsidiaries by ¥40 billion as a result of the acquisition of treasury shares by Kyowa Kirin Co., Ltd. The Company pays dividends with a target payout ratio of 40% or more on a normalized EPS basis based on the policy of implementing a stable and continuous shareholder returns. As a result, dividends paid, including to non-controlling interests, amounted to ¥72.7 billion.

The Group is conscious of the cost of capital and aims to achieve more stable and sustainable dividends. We will introduce a progressive dividend in addition to the change from a consolidated dividend payout ratio of at least 40% on a normalized EPS to one that aims for a consolidated divided on equity (DOE) of 5% or more. We place top priority on stable dividends, and consider investments and shareholder returns in accordance with cash balance while repaying interest-bearing debt and investing in intangible assets for future growth.

② Basic capital policy

The Company will allocate resources to its businesses and distribute profits to its shareholders as set out below.

Regarding resource allocation to businesses, giving top priority to growth investment with a focus on the Health Science domain, the Company will make investments that contribute to enhancement of existing businesses and profitability improvement. The Company will also implement a stable and continuous allocation of resources to intangible value (such as brands, research and development, information and communication technology (ICT), and human resources) as well as new business creation that sustain the growth of future cash flows. The Company will take a disciplined approach to investments in terms of maintaining and improving the Kirin Group’s capital efficiency.

We view the distribution of profits to shareholders as a key management matter. Since our listing in 1949, we have continued to pay dividends without fail in every fiscal year. We will pay dividends until FY2024 with a target payout ratio of 40% or more on a normalized EPS basis. From FY2025 onwards, in order to achieve more stable and sustainable dividends, we will change our dividend policy to one that aims for a consolidated divided on equity (DOE) of 5% or more. In principle, we will pay a progressive dividend per share. As part of management that is conscious of capital costs with the aim of increasing corporate value, we will strive to further enhance the return of profits to shareholders and improve capital efficiency. We will continue to consider whether or not to repurchase our own shares as an additional form of shareholder return, taking into account the optimal capital structure, the market environment, and our capital capacity after the investment.

With regard to financing, priority is given to debt financing, while maintaining a high credit rating that is not affected by financial conditions, in preparation for rapid changes in the economic environment and other factors. The Company fulfills its accountability to its shareholders by carefully considering the impact on stakeholders and other factors when raising funds for investments required to achieve medium- to long-term goals, which may result in a change in control or a large-scale dilution, after verification and review by the Board.