Message from the CFO

May 30, 2025

Kirin Holdings Company, Limited

Engaging in Work With a Sense of Speed to Maximize the Kirin Group’s Corporate Value

FY2024 was a year of gaining confidence from the steady improvement in our organizational capabilities

Please share your reflections on FY2024, the final fiscal year of the Kirin Group 2022–2024 Medium-Term Business Plan (2022 MTBP), based on the Group’s accomplishments of the 2022 MTBP.

Looking back at these past three years, the external environment has significantly changed since we established the 2022 MTBP. We withdrew our business from Myanmar after the army’s coup d’état broke out in 2021, and global inflation surged due to Russia’s invasion of Ukraine, heavily affecting our business.

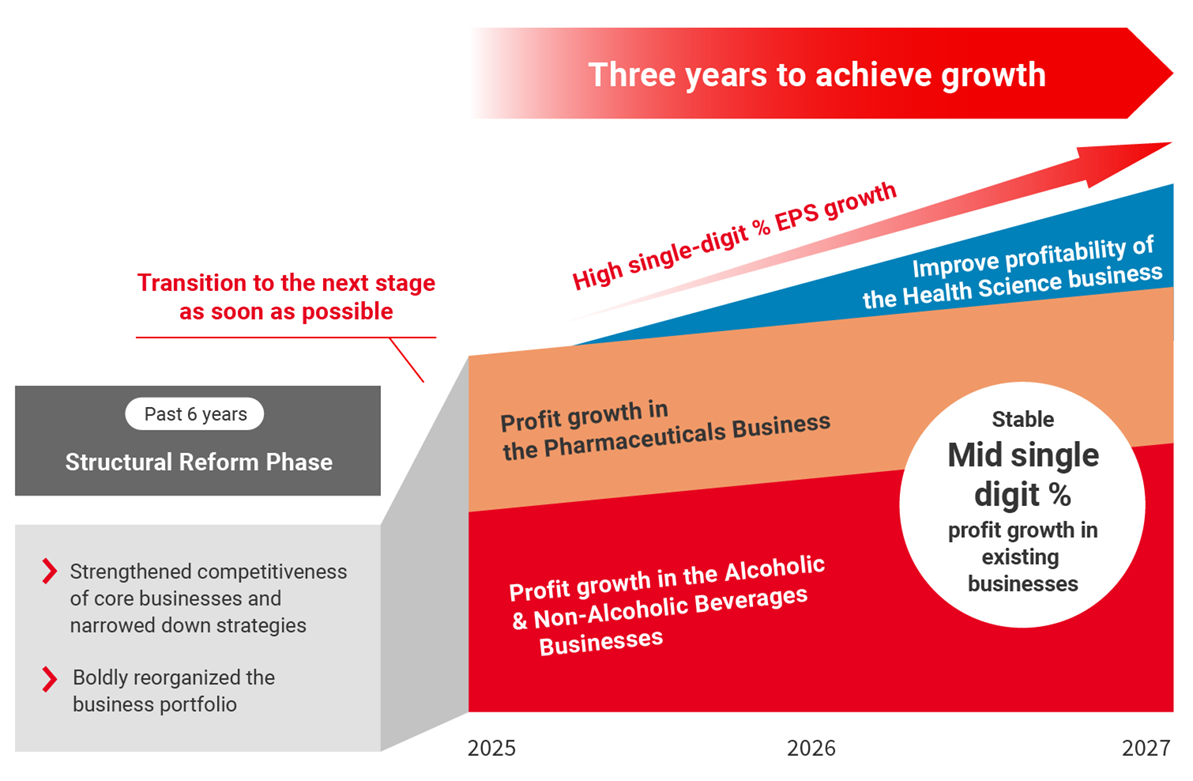

As a result of the impacts of these unexpected environmental changes, we fell short of our goals for return on invested capital (ROIC) and normalized earnings per share (EPS). This is a major point of reflection for us. Meanwhile, our organizational capabilities have steadily improved, with existing businesses, such as the Alcoholic Beverages and Non-Alcoholic Beverages Businesses, achieving price increases across multiple businesses through initiatives to enhance brand equity and optimize revenue management and achieving higher revenue and normalized operating profit than last year. In addition, following our acquisition of Blackmores Limited in 2023, FANCL Corporation was made a consolidated subsidiary of the Kirin Group, and we also signed an agreement on the transfer of Kyowa Hakko Bio Co., Ltd.’s amino acid business and others, which was an obstacle to the profitability of our Health Science Business. Although these were factors that prevented us from obtaining our quantitative targets, we believe we made positive decisions necessary for the future growth of our Group.

Last year, I was committed to obtaining understanding of and sympathizing with the Group’s vision from numerous stakeholders, including investors, through having engagements with them. Two years have passed since being appointed as CFO, and I am gradually strengthening relations with all stakeholders and deepening their understanding of our management, which fills me with confidence.

Please tell us about financial results from the perspective of the financial strategy proposed in the 2022 MTBP and issues for this year and beyond.

We first planned for 700 billion yen in operating cash flow for the 2022 MTBP, but in the end, we only achieved 580 billion yen. On the other hand, the generation of free cash flow is progressing on track due to restructuring our business portfolio and balance sheet management, so the overall cash allocation is as we expected. However, although global costs grew more than expected, I recognize that we must reflect on why we were unable to achieve our goal in operating cash flow because it displays our earning capabilities. Going forward, I believe this is the most important point to focus on.

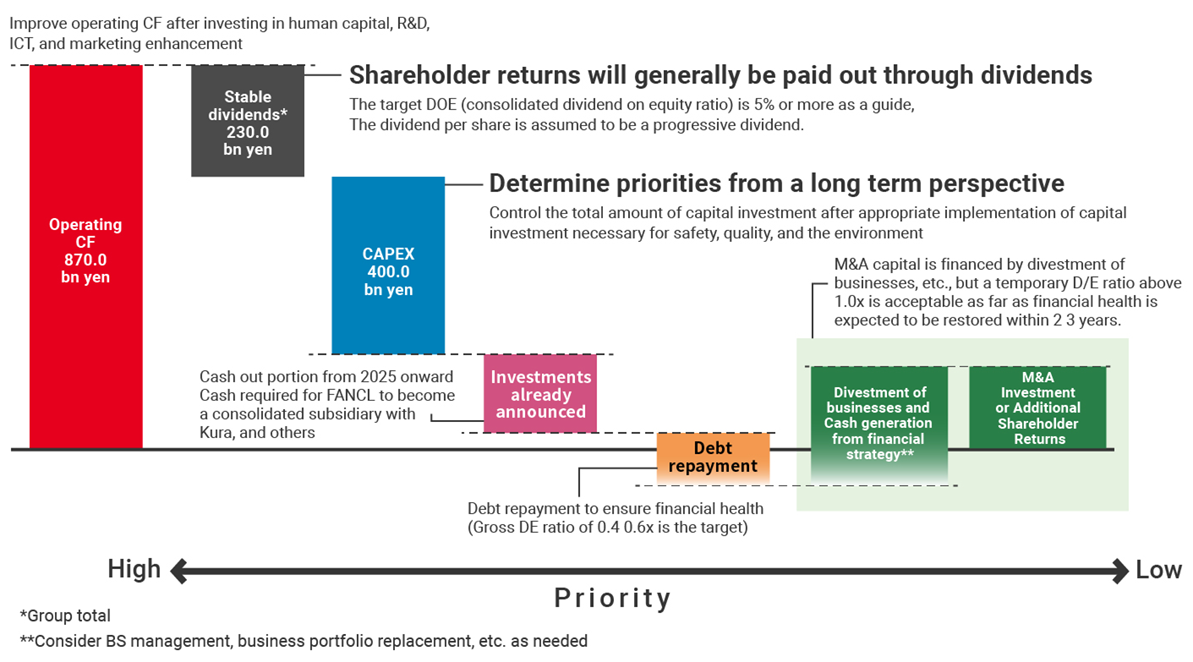

We have set a goal of 870 billion yen in operating cash flow for 2025 to 2027. Since we finally established the foundation for our Health Science Business in FY2024, we will now strive to maximize free cash flow through organic growth of the existing businesses as well as by reducing costs, mainly by eliminating overlapping areas of acquired businesses such as Blackmores and FANCL.

Currently, we are implementing financial modeling to precisely predict three years into the future, and we expect to reduce our debt by the end of 2027 to the same level it was in 2022 and develop enough capacity to make our next investment. We plan to repay our debts using operating cash flow, so we will secure profits by making necessary investments into our existing businesses, and then consider strategic investment targets.

Building an organizational structure more resilient against change and improving profitability

Please explain this year’s shift from a set three-year medium-term business plan to an annually rolling three-year plan.

In a rapidly changing external environment, it becomes difficult to flexibly respond to issues when restricted by a set three-year plan, and there is a risk of focusing too much on the numbers and failing to be able to make necessary investments for our future. Additionally, during the previous set three-year business plan, there was an issue of seeing nothing but the goals of the final fiscal year of the plan when the end of its period approached. Based on these circumstances, we decided to formulate a three-year plan for every fiscal year and roll it over into the following year. For example, if our goals for the three-year plan appear in reach at the end of the fiscal year it was formulated, we’ll extend the plan. However, if there is an unexpected occurrence, we will adjust our goals to be in line with the new situation.

That said, we will continue to commit to our long-term goals, including Long-Term Management Vision, Kirin Group Vision 2027 (KV2027), and will set parts of executive remunerations based on the achievement of these long-term goals. By keeping long-term goals and shifting short- and medium-term goals to a rolling system that can be flexibly changed to suit current conditions, we will build an organizational structure more resilient against environmental change.

Why is the Group shifting from Normalized EPS to EPS? And what initiatives do you plan to take toward improving ROIC?

EPS symbolizes an enterprise’s earning capabilities, but it can be affected by temporary increases or decreases in profit from extraordinary losses and divestments of businesses and other factors. Our Group focused on rearranging our business portfolio, creating a situation in which EPS was also likely to be affected. As this, in turn, made it difficult to see our earning capabilities as an enterprise, we adopted Normalized EPS, which excludes one-time special factors.

At the same time, we were being told by some investors it was difficult for investors to understand what is “normalized.” In addition, based on the future EPS helping us to healthily understand and manage net profit, we decided to switch to EPS and make easy-to-understand disclosures now that our business portfolio revision has been completed to some extent. However, to provide an appropriate starting point where one-time events are not taken into account, we will calculate normalized EPS only for the reference year going forward.

We introduced ROIC from the perspective of not only a capital efficiency that leads to improved corporate value but also of maintaining financial discipline.

Without it, a company could prioritize increasing the total amount of normalized operating profit, even if the profit margin, for example, is a low, single-digit percentage, by simply making more investments in assets with a similar margin. Nevertheless, because this will cause our profit margin to fall short of expectations of our shareholders and investors, we also applied ROIC in operating companies as an indicator for maintaining financial discipline. More specifically, by sharing progress in goals set by operating companies to reduce working capital, shorten the cash conversion cycle (CCC), and reduce COGS to improve gross profit, Kirin Holdings is providing support in these efforts. Additionally, while revising the business portfolio, we are remaining cautious about its effect on the entire Group’s ROIC.

All operations, including sales, procurement, and logistics, are connected to cash flow, so there are many opportunities to improve them by making efforts in each area. However, employees still find ROIC unfamiliar, and I think it is difficult for each employee to be aware of it while working. Thus, we believe it is important to set process goals that subdivide ROIC and work them into the goals of each business and division. Thus, we are committed to building a system that will enable us to execute business operations with an awareness of ROIC by monitoring results periodically. Focusing on my duty to connect business and finance by utilizing my experiences in the Operating Company Planning Department and Kirin Holdings’ Corporate Strategy Department, I will work to improve our organizational culture.

Please elaborate on your views about businesses that are below the cost of equity.

Our Group’s weighted average cost of capital (WACC) is calculated at approximately 6.0%, and most of our businesses operate above the WACC, but it is true there are some businesses that do not. Kirin Holdings instructs operating companies that need to be restructured to formulate restructuring plans and comes together with them to improve the situation. As a result, when it is difficult for us to restructure a company alone, we consider other options, including selling the company to an owner who can best manage the business and make more of it than we can or withdrawing from it.

Business continuity is based on each business exceeding its WACC. However, as it is possible for the profit margin to temporarily lower depending on the business stage, if we have decided there is a strategic reason to hold on to a business that is lower than its WACC, we will continue the business. In such a case, we will continuously check the condition of the business’s profit margin to see it does not remain low for the long-term, and, if there is a problem, we will work as a Group to restructure the business.

Expanding earning capabilities through the four businesses connected by fermentation and biotechnology

As CFO, how would you rate the Kirin Group’s business portfolio?

Our Group has a portfolio comprising four business domains, with fermentation and biotechnology as its core competencies. We also allocate operating capital according to each business’ life stage, and there are no plans to change this policy in the near future.

Our founding Alcoholic Beverages Business has entered its maturity stage, and in light of the declining population, society’s increased health awareness, the strengthening of alcohol restrictions, and more, I believe the strategy of maintaining a stable foundation for the Alcoholic Beverages Business, while expanding our Health Science Business, and shifting to a healthier Non-Alcoholic Beverages Business is also a viable option. In addition, our Pharmaceuticals Business not only has its own growth potential but is also a vital asset for expanding our Health Science Business. Therefore, we will maintain our current ownership structure for the time being, taking into consideration the cash allocation strategy of the entire Group.

Now that we have somewhat established our business portfolio, we are being asked to create synergy between our businesses, which we recognize as essential. Our Group has expanded from its parent Alcoholic Beverages Business to include Non-Alcoholic Beverages, Pharmaceuticals, and Health Science Businesses by applying technologies and knowledge from each business, so each business has been displaying synergy since their launch. Additionally, the functions of each business, including research and development (R&D), product technologies, quality management, marketing, and digital ICT (information and communication technology), can be shared across businesses and are contributing to maximizing the business’ added value.

Looking back, the Non-Alcoholic Beverages Business was born from the beer-making technology of the Alcoholic Beverages Business, and the Pharmaceuticals Business was started from the fermentation and biotechnology that were honed by working with beer yeast and are used to control microorganisms. In launching the plants for the Pharmaceuticals Business, the engineering technology of Kirin Brewery, Limited, was put to great use.

The technology and knowledge contained in the Pharmaceuticals Business are also a great help in the Health Science Business. The high affinity of the Pharmaceuticals and Health Science Businesses is symbolized by Cowellnex, a 50:50 joint venture launched by Kirin Holdings and Kyowa Kirin Co., Ltd., last year. Our Group is focusing on R&D, and there are cases where we do not know if the material being researched will be for a pharmaceutical, food, or beverage product, and sometimes the same material may be judged differently in different countries, like citicoline. Against this backdrop, Cowellnex was established as a platform for R&D to connect pharmaceuticals and health science.

Furthermore, some people are of the opinion that FANCL’s cosmetics business is a new sector for the Group, but we just see it as a part of the Health Science Business. This is because cosmetics are largely split into two products—makeup and skin care—and FANCL’s business mainly deals with skin care products.

We believe skincare has a strong affinity with our existing businesses because we can address skin health both internally and externally by using beverages and supplements for inner health and skincare products for external.

On top of that, FANCL has approximately 2.8 million purchasing touchpoints per year, and by combining this with our Group’s marketing, we believe we can strengthen the presence of each of our brands. In addition, we will accelerate our growth globally by leveraging Blackmores’ overseas sales network and regulatory compliance capabilities, mainly in Southeast Asia and Oceania, to develop FANCL’s outstanding supplement and skincare products.

In other words, all our businesses are interconnected, and because we believe these connections to be an important synergy, we aim to maximize their impacts.

Leveling up as a global company

Can you please talk about your initiatives in balance sheet management?

Since 2022, we have expanded the implementation of the global cash management system (GCMS) to more group companies and have established a system that can control cash, such as the lump-sum borrowing of surplus funds and loans of deficient funds. Through this, in the three years between 2022 and 2024, we reduced the surplus funds (funds set aside for risks) of each company by more than 80 billion yen. Going forward, we want to advance this one step further and quickly implement GCMS at newly consolidated companies, including FANCL.

In regard to CCC, we improved working capital by a total of 20 billion yen during the period of the 2022 MTBP by introducing Systems Applications and Products (SAP) to improve processes. In the future, we aim to further shorten CCC by promoting further process improvement through using SAP and promoting DX, improving supply and demand accuracy, and reducing inventory.

We are also continuously striving to reduce cross-shareholdings. In the three years leading up to last year, we had already reduced them by 17 billion yen, bringing their share of total capital to approximately 4%, well below the level required by proxy advisory firms. Every year, the Board of Directors reevaluates whether to keep the cross-shareholdings, and, if there are any that it would not be reasonable to hold on to, we proceed with selling them in a timely and appropriate manner through future dialogue with our business partners.

Since our Group used to mainly consist of Japanese businesses, we have managed currency with a focus on the Japanese yen. However, now a lot of money comes in as US dollars, so we need to take a broader perspective and include currencies other than the yen. Thus, we will consider how to appropriately handle each currency, such as how much of each currency to have, and further establish a system that enables the effective use of funds.

As part of growth investments, what are your thoughts and stance on investments in non-financial assets?

Last year, we also actively invested in non-financial assets, such as in cultivating brands and updating old facilities in the Alcoholic Beverages and Non-Alcoholic Beverages Businesses, R&D for the Pharmaceuticals Business, ICT in the digital field, and the human capital to implement these things. We valued making appropriate investments in non-financial assets to build a foundation for sustainable growth and value creation in each business, and we plan to maintain this policy.

In recent years, there has been an increase in global demand for disclosing non-financial information, and in response to this, we newly established the Corporate Disclosure Section within Kirin Holdings’ Finance Department. This section will verify hypotheses concerning the correlation and causality between non-financial and financial information to heighten the effectiveness of our investments in non-financial assets. As you know, there is no standard method established for measuring how much investments in non-financial assets will affect financial indicators, but it is truly important to manage a company with an awareness of how investments in non-financial capital will improve the company’s future value, so we will first start these efforts as pilot initiatives. By the Finance Department handling and disclosing both financial and non-financial information, I hope we will further deepen constructive engagement with all stakeholders.

Furthermore, our Group has introduced SAP to improve our management capabilities as a group. SAP has been fully implemented, but going forward we will promote the coordination and mutual use of data between Group companies to make management information visible and transparent. Currently, for example, both Kirin Brewery and Lion Pty Ltd are using SAP, but the rules for digitizing manufacturing costs and other information vary depending on the company. This year, we will work to standardize the rules for such data and granularity as soon as possible by utilizing the Corporate Strategy Department’s track record and experience in handling DX.

In order to promote standardization, we must change the system and our workstyles, meaning there could be a temporary increase in employee burden. However, we will strive to update job processes to be suited for the new system and nurture human capital for these processes, so we can maximize the merits gained from this by the entire company.

Implementing plans with a sense of speed to gain confidence in improving our corporate value

What are your thoughts on shareholder returns?

Our Group considers the appropriate return of profits to shareholders through dividends to be one of its highest management priorities. We have never reduced dividends before and have been committed to stable dividends based on a dividend payout ratio of 40% of normalized EPS. From FY2025, in order to further promote management with an awareness of cost of equity, we have decided to introduce dividends through dividend on equity ratio (DOE). By simultaneously adopting a principle of progressive dividends, we will realize more stable and sustainable returns.

Meanwhile, we are also conscious of total shareholder returns (TSR) and will make investments in aim of realizing the growth required by investors. Additionally, we will implement measures for shareholders returns, including share buybacks, but please understand this is only if we do not find suitable investees.

As CFO, what do you think about the current stock price levels?

I understand the current stock price levels are not necessarily satisfactory for shareholders and investors. Stock prices reflect the value of a company’s future growth in numbers. Although we have achieved record profits three years in a row, our current stock prices show that the stock market has not shown confidence in our Group’s future growth.

The 2022 MTBP was implemented during a period when we restructured our portfolio, which included the sale of our stake in China Resources Kirin Beverages Company Ltd., the signing of an agreement on the transfer of Kyowa Hakko Bio Co., Ltd.’s amino acid business and others, and the acquisitions of Blackmores and FANCL. Looking at other companies, there are multiple examples of stock prices slumping during portfolio restructuring. However, we certainly do not believe our Group’s current stock price levels are sufficient, and I want to engage with investors so we can reflect our company’s value in our stock prices as soon as possible.

More and more people are coming to understand the direction of our Group’s strategies and business portfolio restructuring. On top of that, it is vital that we quickly establish the Health Science Business, which holds the key to future profit growth, and we believe our ability to execute this will lead to gaining high expectations for improvement in our corporate value from shareholders and investors. As I said earlier, with the acquisitions of FANCL and Blackmores and signing an agreement on the transfer of Kyowa Hakko Bio Co., Ltd.’s amino acid business and others, I believe there has been great progress in building the foundation for our Health Science Business. By actualizing this growth with a sense of speed, we will meet everyone’s expectations.