[Food & Beverages domain]

Global Beer Consumption by Country in 2021

- Other

December 23, 2022

Kirin Brewery Company, Limited

- Global beer consumption increased for the first time in two years, showing post-COVID recovery

- China the largest overall consumer for the 19th straight year, with Asia the leading region

- The Czech Republic remained the top per-capita consumer for the 29th consecutive year

TOKYO, Friday December 23, 2022 -Kirin Holdings Company, Limited (Kirin Holdings) published the Global Beer Consumption Report for 2021 which summarizes the details of global beer consumption in 170 major countries and regions. The report is based on findings obtained from questionnaires sent by Kirin Holdings to various brewers’ associations around the world, as well as the latest industry statistics available overseas. The data for global beer consumption has been tracked by Kirin since 1975.

| Main Topics |

|---|

|

■ Global beer consumption stood at approximately 185.60 million kiloliters in 2021, an increase of 4.0% year-on-year. This is equivalent of filling up the Tokyo Dome about 150 times. ■ China remained the largest beer-consuming country in the world for the 19th consecutive year, and consumption increased in 2021 by 5.6% year-on-year. Japan (down 5.2% from the previous year) dropped one spot to 8th place – the first decline in 15 years. India (up 28.2% from the previous year), dropped to 24th place in 2020 due to the impact of the spread of the COVID-19, but recovered to 14th place in 2021. ■ Among the top 10 countries, positive growth was seen in the United States, Brazil, and Russia compared to 2019 (pre-COVID-19). ■ By region, Asia consumption was up 3.5% year-on-year, and holds a 31.4% share of the global beer market, remaining the world’s largest beer-consuming region for the 14th consecutive year. |

Total global beer consumption in 2021 increased by approximately 7.13 million kl (equivalent to approximately 11.3 billion 633ml bottles) from the previous year due to the easing of the impact of the spread of COVID-19, to approximately 185.6 million kl (up 4.0% from the previous year, or approximately 293.2 billion 633ml bottles equivalent). This would be equivalent to about 150 Tokyo Domes (Tokyo Dome=about 1.24 million kl).

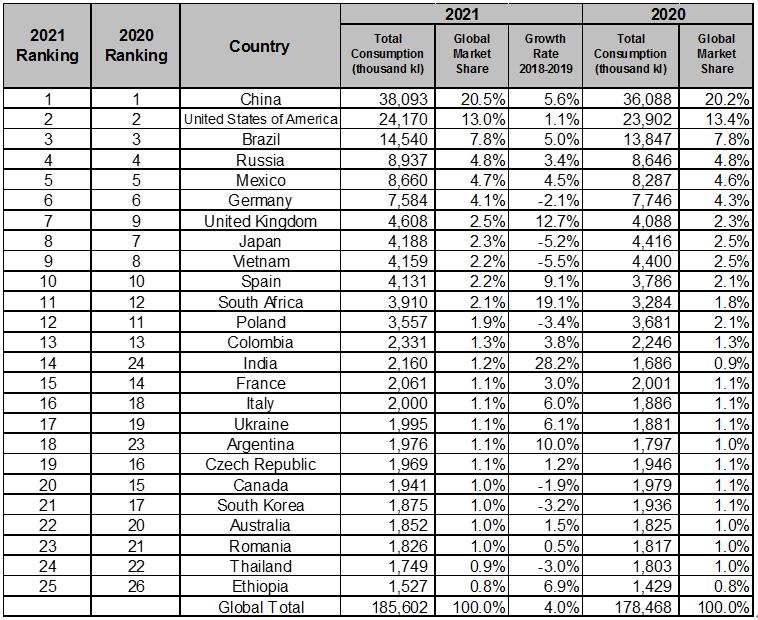

1. Global Beer Consumption by Country in 2021 (Table 1)

・ China remained the largest beer-consuming country in the world for the 19th consecutive year since 2003, an increase of 5.6% compared to 2020.

・ Japan dropped one place to eighth, its first decrease in 15 years since 2007, consuming 5.2% less beer than 2020.

・ India recovered significantly from 24th in 2020 to 14th place in 2021 (increase of 28.2% from the previous year)

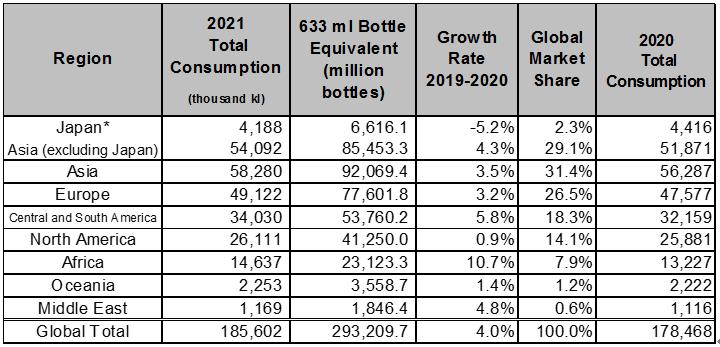

2. Global Beer Consumption by Region in 2021 (Table 2)

・ Asia remained the world’s largest beer-consuming region for the 14th consecutive year, consuming 3.5% more beer compared to 2020 with China and India leading the way, with increases of 5.6% and 28.2% respectively, over 2020.

3. Per-capita Beer Consumption by Country in 2021 (Table 3)

・ The Czech Republic remained the world’s top in per-capita beer consumption for the 29th consecutive year since 1993.

・ Among the top 35 countries, eight countries saw a decrease in consumption from 2020 to 2021.

・ Japan consumed 33.2 liters of beer—the equivalent of about 52.5 633ml bottles—on a per-capita basis in 2021, down the equivalent of 2.7 633ml bottles year-on-year.

Sources:

Questionnaires sent by Kirin to the brewers’ associations in major countries.

The Barth Report Hops 2021/2022 (BARTH−HAAS GROUP)

Global Beverage Forecasts September 2022 (GlobalData Plc)

*Figures may not match those in past reports due to a change in the survey data company after FY2013.

The Jozo Sangyo Shimbunsha estimates consumption in Japan.

*Consumption volume in Japan is a combination of beer, happo-shu (malt liquor), and new genre (non-malt beer).

Note:

Due to rounding, the figures may not necessarily add up.

Among the countries whose figures for the previous year were revised for this year’s report, the revised figures are used to calculate year-on-year changes.

*The volume of global consumption for the previous year has been updated (revised from 177.50 million kiloliters to 178.46 million kiloliters).

About Kirin Holdings

Kirin Holdings Company, Limited is an international company that operates in the Food & Beverages domain (Food & Beverages businesses), Pharmaceuticals domain (Pharmaceuticals businesses), and Health Science domain (Health Science business), both in Japan and across the globe.

Kirin Holdings can trace its roots to Japan Brewery which was established in 1885. Japan Brewery became Kirin Brewery in 1907. Since then, the company expanded its business with fermentation and biotechnology as its core technologies, and entered the pharmaceutical business in the 1980s, all of which continue to be global growth centers. In 2007, Kirin Holdings was established as a pure holding company and is currently focusing on boosting its Health Science domain.

Under the Kirin Group Vision 2027 (KV 2027), a long-term management plan launched in 2019, the Kirin Group aims to become “A global leader in CSV* creating value across our world of Food & Beverages to Pharmaceuticals.” Going forward, the Kirin Group will continue to leverage its strengths to create both social and economic value through its businesses, with the aim of achieving sustainable growth in corporate value.

*: Creating Shared Value. Combined added value for consumers as well as for society at large

(Table 1) Global Beer Consumption by Country in 2021

Comments

・ Global beer consumption stood at approximately 185.60 million kiloliters. 2020 was negative due to the impact of the spread of COVID-19, but a recovery was seen in 2021, resulting in a 4.0% increase over the previous year.

・ China ranked first for the 19th consecutive year with a 5.6% increase over the previous year, but looking at other major Asian countries, Japan, Vietnam, South Korea, and Thailand showed a downtrend with decreases of 5.2%, 5.5%, 3.2%, and 3.0%, respectively, year-on-year.

・ India (+28.2% year-on-year), which dropped from 13th in 2019 to 24th in 2020, recovered significantly to 14th place.

・ Among the top 10 countries, positive growth was seen in the United States, Brazil, and Russia compared to 2019 (pre-COVID-19, total consumption for 2019: approx. 190.20 million kl), showing increases of 1.5%, 9.5%, and 7.6%, respectively.

(Table 2) Global Beer Consumption by Region in 2021

-

Note: Consumption volume in Japan is a combination of beer, happo-shu (malt liquor), and new genre (non-malt beer).

-

Comments

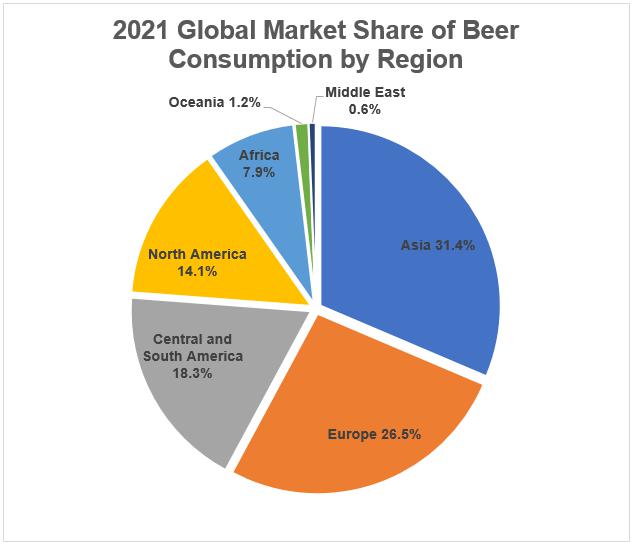

・ Annual beer consumption in Asia was the highest in the world for the 14th consecutive year, with an increase of 3.5% from the previous year with a global market share of 31.4%.

・ Asia, in first place, saw an overall 3.5% increase over the previous year mainly due to increases of 5.6% and 28.2% in China and India respectively, while consumption in Japan, Vietnam and Korea declined by 5.2%, 5.5% and 3.2%, respectively.

・ Europe, ranking second, recorded an increase of 3.2% from the previous year due to increases in consumption in Russia and the United Kingdom of 3.4% and 12.7% respectively, although consumption decreased in Germany by 2.1%.

・ Central and South America, ranking third, saw a 5.8% increase over the previous year as consumption in Brazil and Mexico rose 5.0% and 4.7%, respectively.

・ North America, ranking fourth, increased 0.9% from the previous year, with a 1.1% increase in the United States, despite a 1.9% decrease in Canada.

(Table 3) Per-capita Beer Consumption by Country in 2021

Comments

・ The Czech Republic led all other nations in per-capita beer consumption for the 29th consecutive year.

・ Among the top 35 countries ranked by per-capita beer consumption, eight decreased consumption levels from 2020 to 2021.

・ Lithuania is growing rapidly, ranking 19th in 2019, 6th in 2020, and 3rd in 2021.