Overview

Overview on Corporate Governance

In line with the corporate philosophy and "One KIRIN" Values that are shared across the Kirin Group, the Kirin Group believes that achieving the "2027 Vision" outlined in the Kirin Group's Long-Term Management Vision "Kirin Group Vision 2027 (KV2027)" will lead to the Kirin Group's sustainable growth and to greater corporate value over the medium to long term.

Accordingly, the Kirin Group will develop a corporate governance system that is capable of effectively and efficiently reaching that goal.

The Kirin Group believes that cooperation with all of its stakeholders will be indispensable in order to put the corporate philosophy into practice and turn the "2027 Vision" that is based on this philosophy into a reality, and therefore the Group respects its stakeholders' respective viewpoints.

The Kirin Group will disclose information promptly to its shareholders and investors in a transparent, fair and consistent fashion, will proactively engage in constructive dialogue with its shareholders and investors, and will fulfill its accountability with integrity.

Corporate Philosophy

KIRIN brings joy to society by crafting food and healthcare products inspired by the blessings of nature and the insights of our customers.

2027 Vision

A global leader in CSV, creating value across Food & Beverages to Pharmaceuticals

"One KIRIN" Values

"Passion. Integrity. Diversity"

Corporate Governance Policy

Kirin Holdings has established its corporate governance policy.

Stakeholders

The Kirin Group recognizes six stakeholder groups common to all Group companies: customers, shareholders & investors, employees, communities, business partners, and the environment. We will keep in mind that it is essential to cooperate with these stakeholders for the achievement of "2027 Vision". In addition, we will create new value together with all of our stakeholders in the process of turning the "2027 Vision" into a reality.

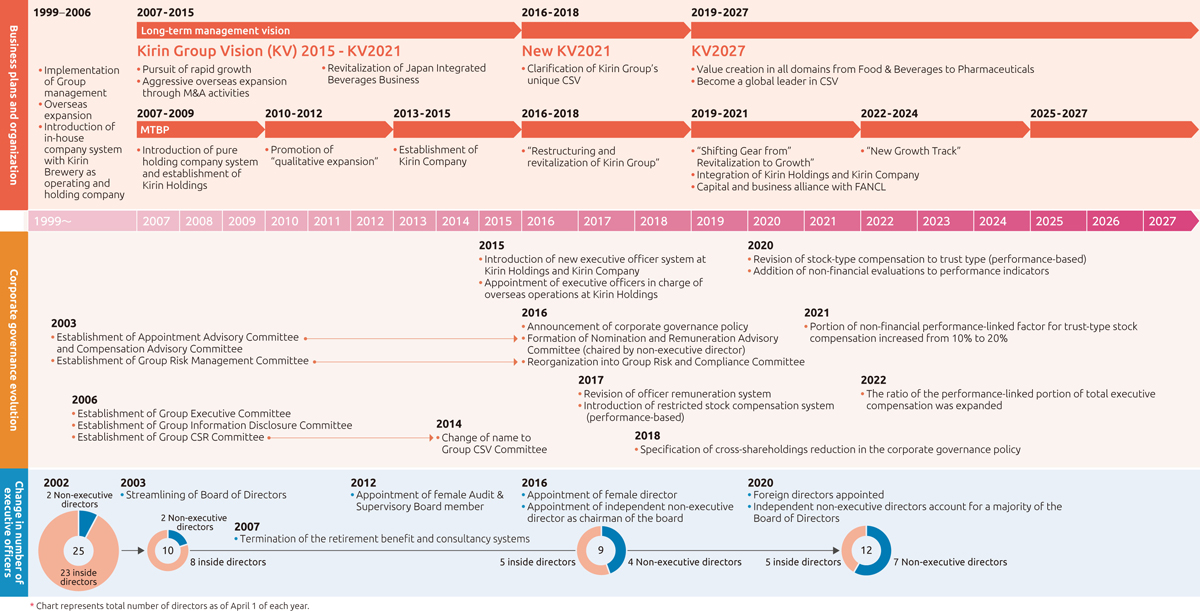

Evolution of Corporate Governance System

Policy on cross-shareholdings

-

In principle, Kirin Holdings will not hold any cross-shareholdings except for stocks that are deemed to contribute to the enhancement of corporate value over the medium to long term.

-

The Board of Directors will annually review the rationale for holding individual cross-shareholdings through dialogue and negotiation with business partners, etc., and will proceed with the sale of stocks that are deemed not to be rational to hold from the standpoint of the common interests of shareholders.

-

Voting rights on cross-shareholdings will be exercised upon deciding for or against each agenda item, taking into account whether a particular cross-shareholding will help boost the corporate value of the company concerned, and whether it will help ensure sustainable growth and boost the Group's corporate value over the medium to long term.

Current Status

-

The Company held one issue of cross-shareholdings with a book value of 500 million yen at the end of 2023.

Related Rules

- Corporate Governance Policy

- Corporate Governance Report

- ESG Databook/GRI Standards Content Index

- Basic policy for the internal control system

- Criteria regarding the independence of Officers

- Independent Officers Notification

- Corporate Disclosure Policy

- Group Compliance Policy

- Kirin Group "Compliance Guidelines"