Management Structure

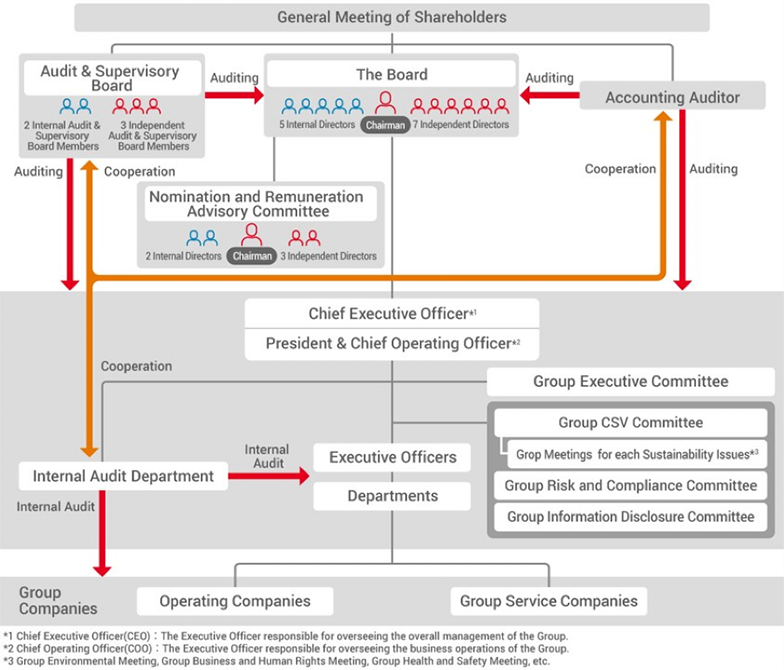

Corporate Governance Structure

-

Kirin Holdings has adopted a pure holding company structure as a means of controlling its diverse and global business, which is centered on 3 domains such as food & beverages, pharmaceuticals and health science. As a pure holding company, Kirin Holdings takes on the role of devising and implementing the Group's overall strategies, monitoring individual businesses, creating synergy, and responding to challenges surrounding sustainability through coordination across the Kirin Group.

-

The Kirin Group's individual companies conduct their business autonomously with a sense of speed, while maintaining close ties to the local customers and other stakeholders. Kirin Holdings grants appropriate authority to match the strategic stages of individual Kirin Group companies and improves governance through the Board of Directors and the Boards of individual group companies by dispatching directors to those companies. Directors, Executive Officers, or their equivalents of Kirin Holdings serve concurrently as directors at the main companies in the Kirin Group.

-

Kirin Holdings has adopted a Company with Audit & Supervisory Board system, and aims to maintain and improve on a highly transparent governance system for its stakeholders. The Board, which includes a number of Outside Directors, works closely with the Audit & Supervisory Board, which also includes a number of Outside Audit & Supervisory Board Members, and makes effective use of the statutory and other auditing function to take final decisions on important matters. At the same time, the Board endeavors to reinforce the monitoring function on management. Kirin Holdings has introduced an executive officer based system in order to implement strategies for each of its businesses and functions in an agile fashion and clarify executive responsibilities. The Board of Directors determines the scope of delegation to the Executive Officers based on their experience, track record, and expertise in their respective fields.

To maintain and improve transparency in the governance system, the Board of Directors at Kirin Holdings actively seeks opinions not only from directors but also from Audit & Supervisory Board members. In this section, we interviewed Yoko Dochi, an external member of the Audit & Supervisory Board, about our governance structure.

The Board of Directors

-

The Board of Directors is responsible for making decisions on important business operations and legal matters of the Group, supervising the directors' execution of their duties, and establishing an appropriate internal control system for the entire Group in cooperation with the Internal Audit Department and supervising its operation. In addition, the Board of Directors determines and approves long-term management concepts and annual business plans for the entire Group and major group companies, and monitors them regularly in light of changes in the business environment in an effort to maximize group corporate value.

-

Taking into account the knowledge, experience, skills and discernment that are necessary for turning the 2027 Vision into a reality, the Board shall be composed of the appropriate number of members, ensuring overall balance and diversity such as gender and internationality, etc. In addition, in order to build a highly transparent governance system and ensure the effectiveness of objective management supervision, the Company appoints a majority of independent outside directors. At least one of the independent outside directors has management experience at other companies.

-

Regarding the Group companies: Kirin Brewery Company, Limited; Lion Pty Ltd; Kirin Beverage Company, Limited; Coca-Cola Beverages Northeast, Inc.; Kyowa Kirin Co., Ltd.; FANCL Corporation; Blackmores Limited (*); Kyowa Hakko Bio Co., Ltd.; and San Miguel Brewery Inc., the Directors of the Board, Executive Officers (limited to those who have a delegated relationship with the Company. The same shall apply hereinafter), or their equivalents of the Company are appointed as Director of the Board (including Non-executive Directors) of each company and supervise the performance of duties in order to strengthen governance of the Group overall. (*The Company takes control over Blackmores Limited by dispatching Directors of the Board to the intermediate holding company). Concerning Kyowa Kirin Co., Ltd., because it is a listed subsidiary, while working to secure appropriate effectiveness through the implementation of the corporate governance code, efforts are being made to ensure the independence of executive management as a listed company, as well as autonomous corporate activities based on independence and agility. At the same time, the Company is striving to maximize profits for all shareholders and sustainably expand corporate value.

-

Kirin Holdings has twelve (12) Directors, of whom seven (7) are Non-Executive Directors, and one of the Non-Executive Directors serve as Chairman of the Board.

-

The Board of Directors meeting is held regularly once a month, and is held as needed.

Frequency and attendance of Board meetings and attendance of individual members of the Board of Directors and the Audit & Supervisory Board

| 2022 | 2023 | 2024 | ||

|---|---|---|---|---|

| Number of meetings | 13 | 15 | 16 | |

| Attendance rate of Non-executive Directors | 97% | 95% | 98% | |

| Attendance rate of Audit & Supervisory Board members | 97% | 98% | 100% | |

| Attendance rate of individual members | ||||

| Executive Director | Yoshinori Isozaki | 100% | 100% | 100% |

| Takeshi Minakata | 100% | 100% | 100% | |

| Junko Tsuboi | - | 100% | 100% | |

| Toru Yoshimura | - | - | 100% | |

| Shinjiro Akieda | - | - | 100% | |

| Non-Executive Director | Masakatsu Mori | 100% | 100% | 100% |

| Hiroyuki Yanagi | 92% | 100% | 94% | |

| Noriko Shiono | 100% | 100% | 100% | |

| Roderick Eddington | 92% | 80% | 100% | |

| George Olcott | 100% | 93% | 100% | |

| Shinya Katanozaka | - | 92% | 100% | |

| Yoshiko Ando | - | 93% | 94% | |

| Standing Audit & Supervisory Board Member | Shobu Nishitani | 100% | 100% | 100% |

| Toru Ishikura | - | 100% | 100% | |

| Audit & Supervisory Board Member | Kaoru Kashima | 92% | 100% | 100% |

| Kenichi Fujinawa | 100% | 100% | 100% | |

| Yoko Dochi | - | - | 100% | |

-

*This table shows the number of Board members as of December 31, 2024. For members appointed during the period, the attendance rate refers to the board of directors meetings held after their appointment.

-

*Extraordinary meetings of the Board held in writing are excluded from the number of meetings.

-

*Director of the Board, Ms. Yoshiko Ando, who previously served as an Audit & Supervisory Board Member became a Non-executive Director following the Ordinary General Meeting of Shareholders held on March 28, 2024. The title presented above is as of the end of the fiscal year under review, and the attendance status includes the number of meetings attended while she served as Audit & Supervisory Board Member.

Evaluation of the Board of Director’s Effectiveness

-

Kirin Holdings defines the Board’s two primary functions as making important corporate decisions and providing supervisory oversight. We conduct an annual evaluation (November-December) of the Board operation and meeting content to both ensure those functions are being fulfilled and to continually improve its efficiency by identifying points to make the meetings more effective in the next fiscal year.

Fiscal 2024 discussion points

-

1.Discussions on “strengthening of corporate governance”

-

2.Discussions on “integrated strategy and risks” to realize appropriate risk-taking

-

3.Discussions on “digital ICT strategy” to accelerate value creation

Fiscal 2024 evaluations

Questionnaires and interviews by the third-party advisors were conducted with all Directors of the Board and Audit & Supervisory Board Members during the period of October through December to evaluate the effectiveness of the Board. Based on the report by the third-party advisors, improvement policy on the issues identified in the current situation was reported and discussed at the Board meeting held in January 2025.

The perspectives and results of the evaluation are as follows.

Observations

-

1.Composition and operation of the Board

-

2.Development, execution and monitoring of strategies

-

3.Supervision of group governance and risk management

-

4.Supervision of decision-making on business acquisition/withdrawal, etc

-

5.Supervision of remuneration for officers and succession plan, etc

-

6.Thorough understanding and implementation of healthy corporate ethics and supervision thereof

-

7.Supervision of overall disclosures to stakeholders

-

8.Strengthening points to improve the effectiveness of the Board

Evaluation results

The report by the third-party advisors concluded that the Board is functioning properly overall, and in general, a high level of effectiveness of the Board is ensured. Accordingly, the Company has determined that the effectiveness of the Board is being maintained.

Points receiving positive evaluations

The following points were positively evaluated in the report by the third-party advisors.

-

Building on a highly diverse composition of members on the Board, Audit & Supervisory Board Members also actively provided their opinions, and the Chairman of the Board ensured that the Board members have the opportunity to speak on a timely basis, creating an environment conducive to free and open discussions.

-

Authority is being delegated to the executive level to a high degree, and the agenda of the Board meetings is focused on crucial topics. Issues pointed out at the Board meetings are adequately addressed and followed up.

-

The Company provides a variety of training opportunities for Non-executive Directors of the Board, including on-site visits, which are generally well received.

-

The opinions of Directors of the Board, Audit & Supervisory Board Members, and relevant parties are incorporated into the operation of the Board in a timely manner, facilitating constant improvement. The capabilities of the secretariat, which supports effective discussions at the Board, are also highly evaluated.

The status of initiatives for the points to improve in FY2024

| Points to improve in FY2024 | Actions taken |

|---|---|

| Discussions on “strengthening of corporate governance” to improve confidence in the capital markets |

|

| Discussions on “integrated strategy and risks” to realize appropriate risk-taking |

|

| Discussions on “digital ICT strategy” to accelerate value creation |

|

Points to improve in fiscal 2025

Management has specified five points for improvement in FY2025 based on the opinions and areas for improvement indicated in the evaluations in FY2024 with a view for the changing business environment. The Company continually seeks to maintain and enhance the effectiveness of the Board by further improving its operation in addition to setting the agenda under the Chairman of the Board Hiroyuki Yanagi, an Independent Non-executive Director.

-

1.Discussions on “business portfolio strategy” to maximize corporate value

-

2.Discussions on growth scenarios for each area and business

-

3.Discussions on “digital ICT” for accelerating value creation through advanced use of AI

-

4.Discussion on “human capital strategy” for nurturing human resources who accomplish and innovate and creating supportive organizational culture

-

5.Discussion on the desirable form of highly effective group governance

Audit & Supervisory Board

-

In keeping with its fiduciary responsibility toward shareholders, the Audit & Supervisory Board ensures the integrity of management with an eye to the Kirin Group's sustainable growth and the improvement of corporate value over the medium to long term, and acts to ensure in the common interests of the shareholders.

-

The Audit & Supervisory Board makes use of the ability of the Standing Audit & Supervisory Board Members to gather information within the Kirin Group and the independence of Audit & Supervisory Board Members. The Audit & Supervisory Board also develops a system to ensure that the audits carried out by each Audit & Supervisory Board Members are effective.

-

In order to intensify the provision of information to Non-Executive Directors, the Audit & Supervisory Board exchanges opinions with Non-Executive Directors and provide them with information obtained in the course of auditing.

-

Kirin Holdings has five (5) Audit & Supervisory Board Members, of whom two (2) are Standing Audit & Supervisory Board Members, and three (3) are Audit & Supervisory Board Members.

Frequency and attendance of Audit & Supervisory Board meetings and attendance of individual members of the Audit & Supervisory Board

| 2022 | 2023 | 2024 | ||

|---|---|---|---|---|

| Number of meetings | 15 | 19 | 18 | |

| Attendance rate of Audit & Supervisory Board members | 100% | 100% | 100% | |

| Attendance rate of individual members | ||||

| Standing Audit & Supervisory Board Member | Shobu Nishitani | 100% | 100% | 100% |

| Toru Ishikura | - | 100% | 100% | |

| Audit & Supervisory Board Member | Kaoru Kashima | 100% | 100% | 100% |

| Kenichi Fujinawa | 100% | 100% | 100% | |

| Yoko Dochi | - | - | 100% | |

-

*This table shows the number of Audit & Supervisory Board members as of December 31, 2024. For Audit & Supervisory Board members appointed during the period, the attendance rate refers to the Audit & Supervisory Board meetings held after their appointment.

Auditor's Audit

Kirin Holdings has adopted an audit system consisting of two (2) Standing Audit & Supervisory Board Members and three (3) Audit & Supervisory Board Members. Each Audit & Supervisory Board Member attends various internal important meetings, including the Board of Directors in accordance with the audit policy and audit plans which are defined by the Audit & Supervisory Board. In addition, the Company has a system in place to adequately audit the status of directors' execution of their duties, including audits of each division of the Company and on-site inspections of domestic and overseas group companies. For Group companies, the Auditors are assigned either full-time or part-time according to the scale of the company. The Auditors of Group companies coordinate closely with the Audit & Supervisory Board Members of Kirin Holdings to enhance the effectiveness of auditing.

Internal Audit

-

The Members of Internal Audit Department are concurrently responsible for conducting regular annual internal audits at Group companies, independently from the auditor’s audit, with regards to the Group’s significant risks and internal controls. The Internal Audit Department practically and efficiently conducts auditing for the Group overall, and by sharing the audit results of, and mutually supplementing the work of, the internal audit and the audit by the Audit & Supervisory Board. The Internal Audit Department Members coordinate with the Audit & Supervisory Board Members in setting and implementing auditing plans, coordinate with the full-time auditors of the key Group companies, and concurrently perform the role of part-time auditors in the Group companies, etc.

-

The Internal Audit Department, the Audit & Supervisory Board Members and an Independent Accounting Auditor also strive for mutual cooperation where they exchange information and opinions and consult each other as necessary. The Internal Audit Department and the Audit & Supervisory Board Members regularly exchange information and opinions with internal control-related departments, and the Accounting Auditor also conducts hearings with internal control-related departments as necessary, both thus implementing effective audits.

Relationship with the Independent Accounting Auditor and Internal Audit Department

-

The Audit & Supervisory Board develops a system capable of conducting thorough and appropriate auditing in coordination with the Independent Accounting Auditors and the Internal Audit Department.

-

The Audit & Supervisory Board verifies the independence and specialization of the Independent Accounting Auditors upon establishing evaluation criteria. The Audit & Supervisory Board holds regular interviews with the Independent Accounting Auditors, and requires the Independent Accounting Auditors to explain whether they are observing the necessary quality management criteria for carrying out accounting audits in an appropriate fashion.

Internal Control System

Kirin Holdings formulates basic policies on internal control systems as a system for ensuring the adequacy of Group operations at a meeting of the Board of Directors and strives to establish and operate appropriate systems for Group compliance, risk management, and ensuring the adequacy of financial reporting. In addition, the Company conducts annual inspections of the maintenance and operation of internal controls to confirm that the activities of the departments responsible for implementing internal controls are self-sustaining and functioning effectively and confirms the details of these inspections at Board meetings.

Group company governance and performance assessment

-

Kirin Holdings formulates and promotes Group strategy, monitors all Group businesses, and creates synergies across the Group. Each Kirin Group company is located close to its customers and stakeholders and administers its operations autonomously and speedily with full authority to make business execution decisions tailored to their specific strategies. Kirin Holdings seats a director on each company’s Board of Directors to help maintain a high level of corporate governance.

-

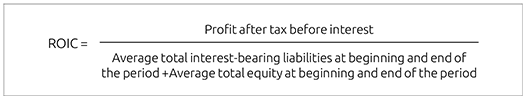

Until 2021, return on assets (ROA) and earnings before income tax (EBIT) for each company, which is directly linked to return on invested capital (ROIC), were used as the performances evaluation indicators for operating companies, and ROIC and business profit are used as unified indicators from 2022.

Nomination & Remuneration Advisory Committee

-

The Nomination & Remuneration Advisory Committee has been set up to deal with the nomination and remuneration of Directors, Executive Officers, and Audit & Supervisory Board Members.

-

As an advisory body to the Board, the Committee discusses the following matters from an objective and fair perspective, and report to the Board of Directors. The matters that are discussed and reported on include the appointment/dismissal policy for Executive Directors, Executive Officers and Audit & Supervisory Board members, the proposed candidates for each position, the remuneration plan and level, the amount of remuneration and the succession plan for those responsible for the management of the Company.

-

The Nomination and Remuneration Advisory Committee shall, based on the delegation of the Board of Directors, determine the evaluation indices and targets for the individual performance evaluation, the evaluation results in accordance with the degree of achievement of those indices and targets, and the individual payment rates for the individual performance evaluation with respect to bonuses for the Company's directors (excluding non-executive directors) and executive officers.

-

The Committee is composed of five (5) Directors, consisting of two (2) Internal Directors and three (3) Non-Executive Directors, The committee chairperson is appointed out of the non-executive directors. The term of office is one (1) year.

-

The members of the committee in 2024 are as follows: Non-executive directors: Ms. Noriko Shiono (Chairperson), Mr. Shinya Katanozaka, Ms. Yoshiko Ando

Internal directors: Mr. Yoshinori Isozaki, Mr. Takeshi Minakata

Frequency and attendance of Nomination and Remuneration Advisory Committee meetings and attendance of individual members of the Board of Directors

| 2022 | 2023 | 2024 | ||

|---|---|---|---|---|

| Number of meetings | 13 | 13 | 13 | |

| Attendance rate of Committee members | 100% | 100% | 100% | |

| Attendance rate of individual members | ||||

| Executive Director | Yoshinori Isozaki | 100% | 100% | 100% |

| Takeshi Minakata | - | - | 100% | |

| - | Noriko Shiono | 100% | 100% | 100% |

| Yoshiko Ando | - | - | 100% | |

| Shinya Katanozaka | - | - | 100% | |

-

*This table shows the number of Committee members as of December 31, 2024. For Committee members appointed during the period, the attendance rate refers to the Nomination and Remuneration Advisory Committee meetings held after their appointment.

Advisory Bodies to the President

The following four bodies have been established as advisory bodies to the President.

1. Group Executive Committee

As an advisory body that assists and supports the President in making decisions, the Company strives to improve the quality of decision-making by flexibly holding meetings consisting of the Executive Officers, including the Senior Executive Officer & President and Executive Officers, Standing Audit & Supervisory Board members, professional advisors and others to discuss Group Executive Committee decisions on strategies and investments that have a major impact on the management of the Group.

2. Group CSV Committee

The Group CSV Committee deliberates the planning of Group CSV policies and strategies and monitors the progress status of CSV initiatives. The committee presents reports to the Board of Directors, which are reflected in the Group's overall strategy.

3. Group Risk and Compliance Committee

The Group Risk and Compliance Committee promotes and supervises risk management and the steadfast execution of compliance. The committee ensures the proper activation of response systems for crisis situations, such as by supporting information sharing and responses among Group companies in Japan and overseas.

4. The Group Information Disclosure Committee

The Group Information Disclosure Committee decides relating to information disclosure to stakeholders and investors, and improves management transparency through the promotion of timely, fair and impartial disclosure. The Chief Financial Officer is appointed as the committee chair. The heads of the department in charge attend the committee, and the standing audit & supervisory board members and the head of internal audit department serve as observers.