Kirin Group Tax Policy

The Kirin Group strives to follow the socially-accepted standards and carry out corporate activities based on our sound judgment pursuant to the corporate philosophy, vision and values. With regards to tax practice, we will comply with the tax standards and we believe that, as a global company, there is a need to ensure tax transparency for our various stakeholders.

The Kirin Group has set forth the following basic policy for tax corporate governance (Tax Policy), which is the principle to proactively manage tax affairs for the entire group.

Tax Compliance

The Kirin Group complies with the relevant tax regulations, tax treaties, and multilateral agreements of each jurisdiction, and fulfills our tax obligations in an appropriate manner based on an understanding of the intent and background of such legislation. In accordance with the intent of the OECD transfer pricing guidelines such as the BEPS (Base Erosion and Profit Shifting) project, the Kirin Group also remits fair and transparent tax payments which are in line with the business objectives of each operating jurisdiction.

Tax Governance

The Group Headquarters’ Chief Financial Officer (CFO), who is a director of the Board, is ultimately responsible for the establishment and maintenance of the Kirin Group’s tax corporate governance, tax risk management and material tax risk.

The Group Finance Department manages the tax affairs of the entire Kirin Group. It also strengthens the structure and environment to facilitate smooth communication between each relevant business unit within the Group Headquarters and its consolidated subsidiaries.

Tax Planning

The Kirin Group shall not engage in excessive tax planning that is considered tax avoidance or tax evasion using tax havens in light of the socially-accepted standards.

The Kirin Group shall conduct sufficient research and examination with multiple options in order to balance rational tax planning with appropriate tax risk management, and shall prepare valid explanations with respect to the reasons for adopting the selected option.

Transfer Pricing

The Kirin Group complies with the OECD transfer pricing guidelines and sets transfer price of intercompany transactions based on the arm’s length principle.

The Kirin Group strives to pay appropriate amounts of tax in each operating jurisdiction, based on the value created by business activities.

The Kirin Group also evaluates on a regular basis whether the income allocation is appropriate in line with the contribution based on the analysis of each group company’s functions, risks and assets, and strives to prepare transfer pricing documentation in accordance with the relevant transfer pricing regulations in each jurisdiction.

Tax Risk Management

The Kirin Group recognizes minor risk possibly arising from uncertainties that are inherent in tax operations.

The Kirin Group deals with tax issues in a rational and transparent manner by consulting with external tax advisors, in the event of any transaction with uncertain tax interpretation being occurred in the course of business activities. In order to ensure its certainty, the Kirin Group strives to reduce tax risk by proactively seeking for available advance rulings by tax authorities.

Tax Incentives

The Kirin Group strives to keep tax cost at a proper level by utilizing applicable tax incentives in accordance with the relevant tax regulations in each jurisdiction.

Relationship with Tax Authorities

The Kirin Group strives to have cooperative relationships with tax authorities by complying with the relevant tax regulations and responding to inquiries from tax authorities in a prompt and courteous manner. The purpose of establishing and maintaining relationships with tax authorities is to enable efficient and cooperative responses to any tax issues and to avoid unreasonable taxation.

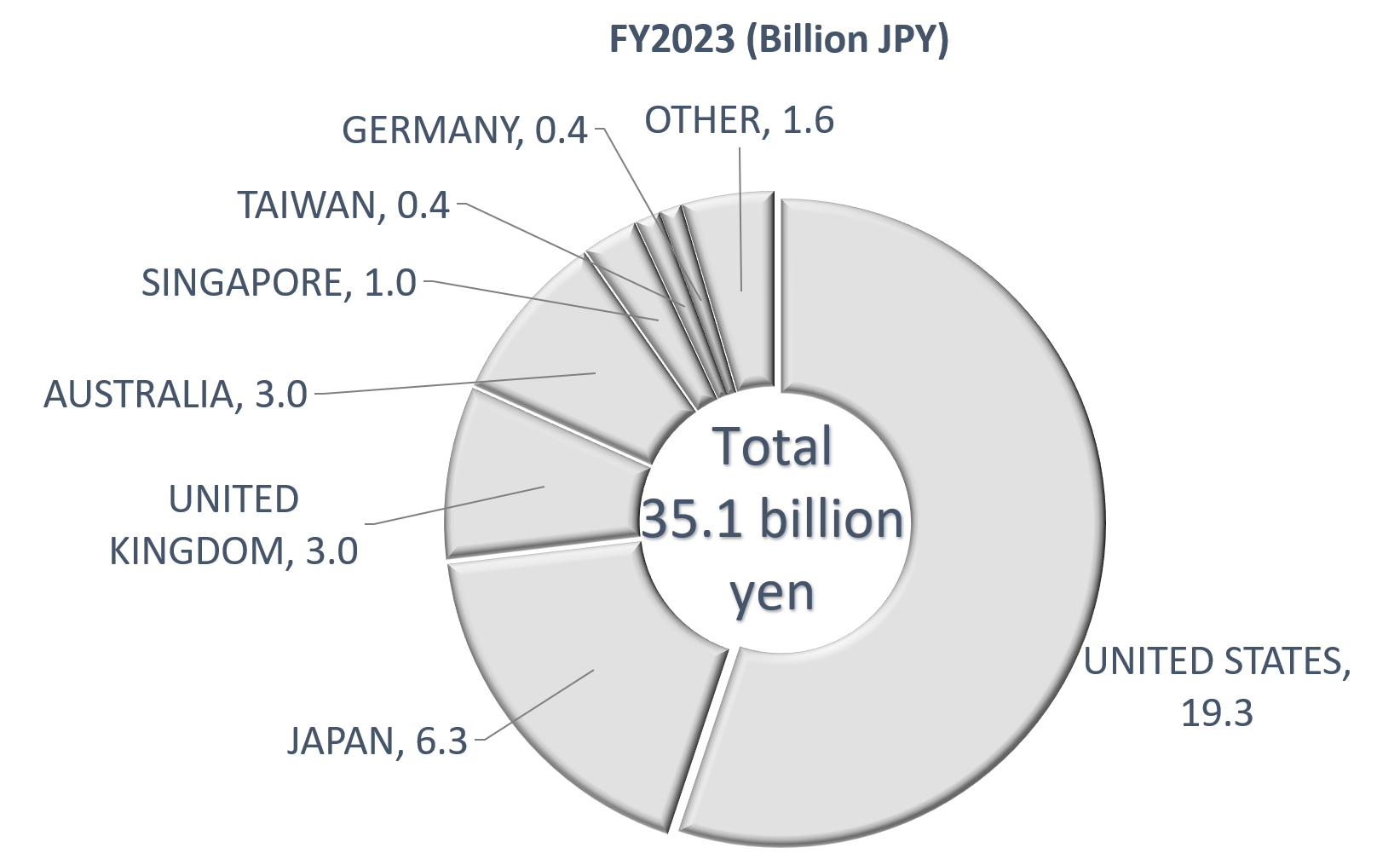

Corporate Income Tax Paid