Long-Term Management Vision

Long-Term Vision KV2027

Growth strategy must be based on the new reality

-

Stronger existing core businesses are essential for growth

-

Social issues such as QOL and preventative healthcare create growth opportunities bridging food and pharmaceuticals

Changes in society

-

Global increase in natural disasters

-

Greater uncertainty caused by drastic changes in economic systems

-

Corporations expected to contribute to resolving social issues

Changes in the market

-

Maturation of beer market in developed countries global shift towards craft beers and premium products

-

Expansion of regulations for alcoholic beverages and mounting pressure to implement sugar tax

-

Introduction of public policies to reduce healthcare costs

Redefine business domain to enable sustainable growth

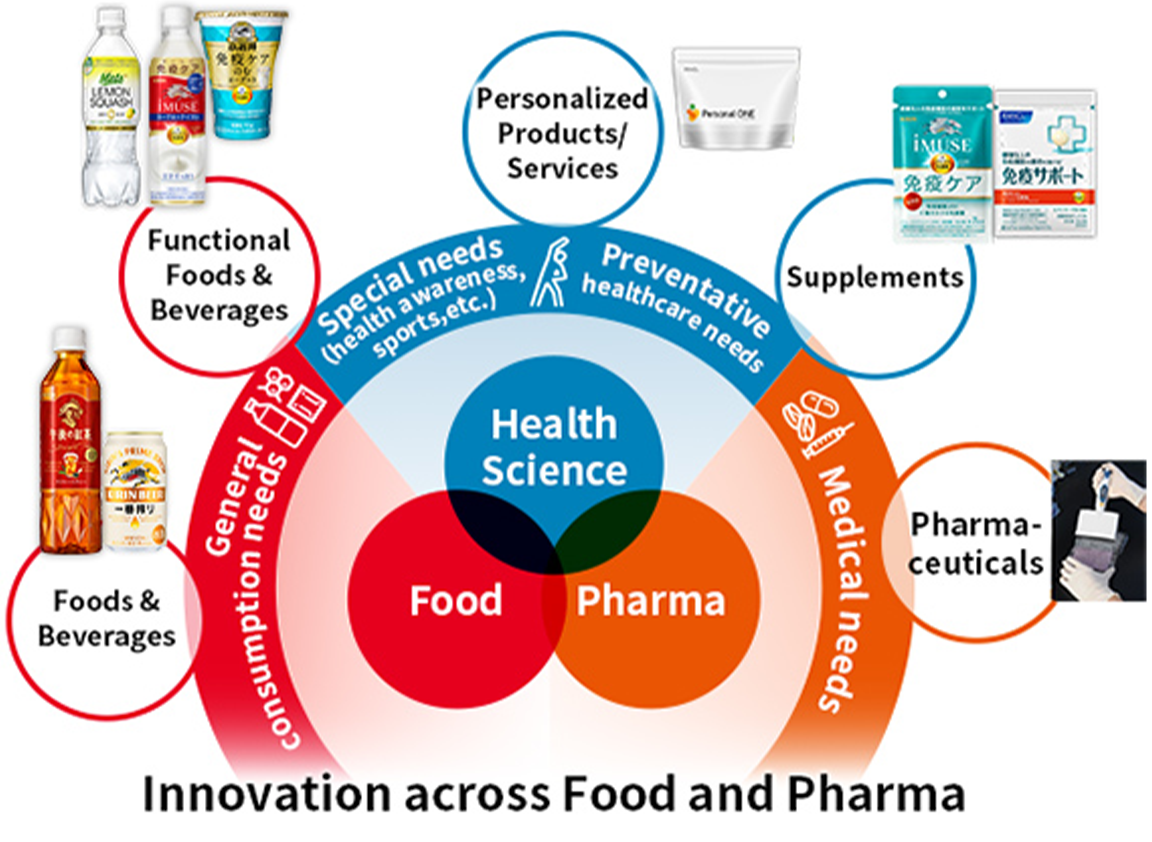

To create value across our world of Food & Beverages to Pharmaceuticals, Kirin Holdings established the Health Science domain to takes advantage of its unique strengths, in addition to the existing business domains, namely the Food & Beverages domain (alcoholic and non-alcoholic beverages businesses) and the Pharmaceuticals domain (Pharmaceuticals Business). In the Health Science domain, Kirin Holdings will grow the business into another core of its business by honing the core fermentation technology and biotechnology that have been cultivated since its founding, and by leveraging the organizational excellence and assets that Kirin Holdings has amassed over the years.

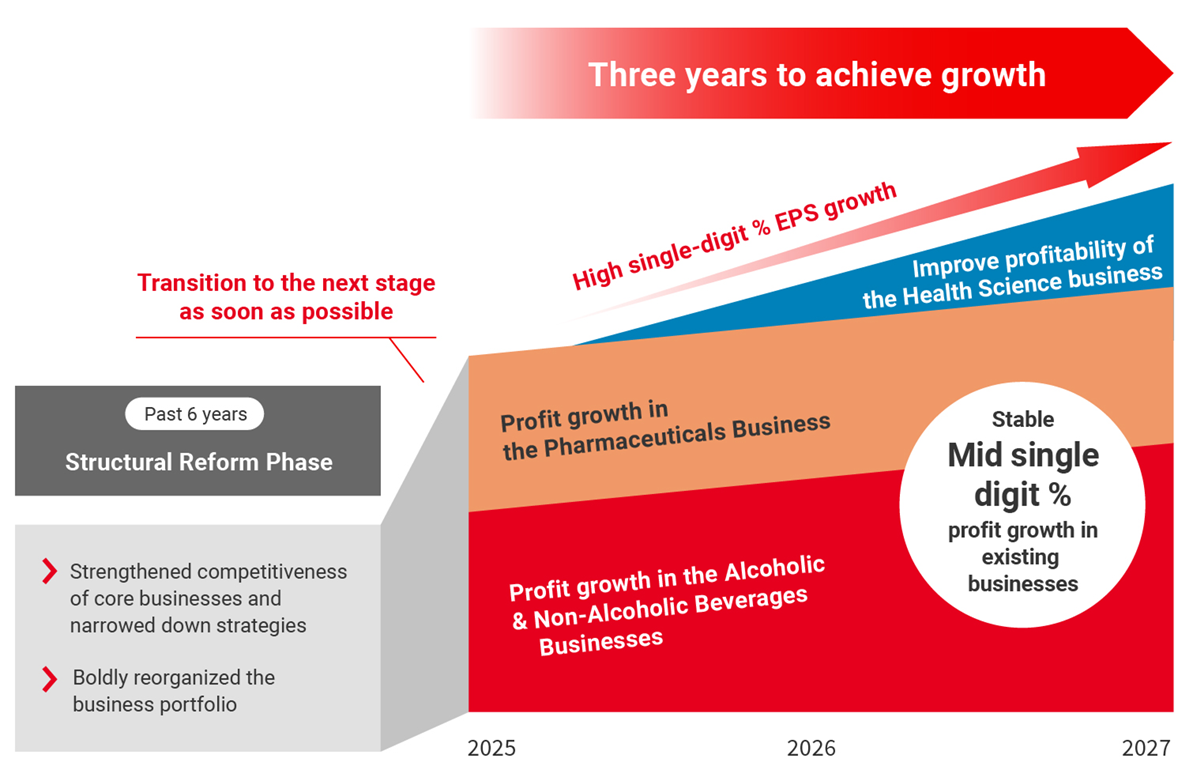

Three years to achieve growth