Holistic Environmental Management Information Disclosure Based on the TCFD Framework, TNFD Framework Draft, etc.

“Holistic Environmental Management Information Disclosure Based on the TCFD Framework, TNFD Framework Draft, etc” is disclosed in the Environmental Report in 2024.

This is also disclosed in the integrated report.

Overview

The following is an excerpt from the disclosure in the Environmental Report 2023, “Holistic Environmental Management Information Disclosure Based on the TCFD Framework, TNFD Framework Draft, etc”. For more information, see Environmental Report 2024.

In this part , we explain how the Kirin Group analyzes and assesses the impacts of climate change and issues related to natural capital and containers and packaging, and promotes transition strategies such as mitigation and adaptation, in order to appropriately and continuously create value. The Kirin Group recognizes the need for a holistic approach to important environmental material themes such as biological resources, water resources, containers and packaging, and climate change, and strives to provide a holistic explanation to the extent possible because there is a risk of trade-offs in resolving individual issues.

When preparing the information in this section, we have complied with the TCFD recommendations (June 2018), the new TCFD guidance (October 2021), and the TNFD recommendations v1.0 (September 2023).In addition, we have referred to the S1 and S2 standards published by the International Sustainability Standards

Board (ISSB) in parts.

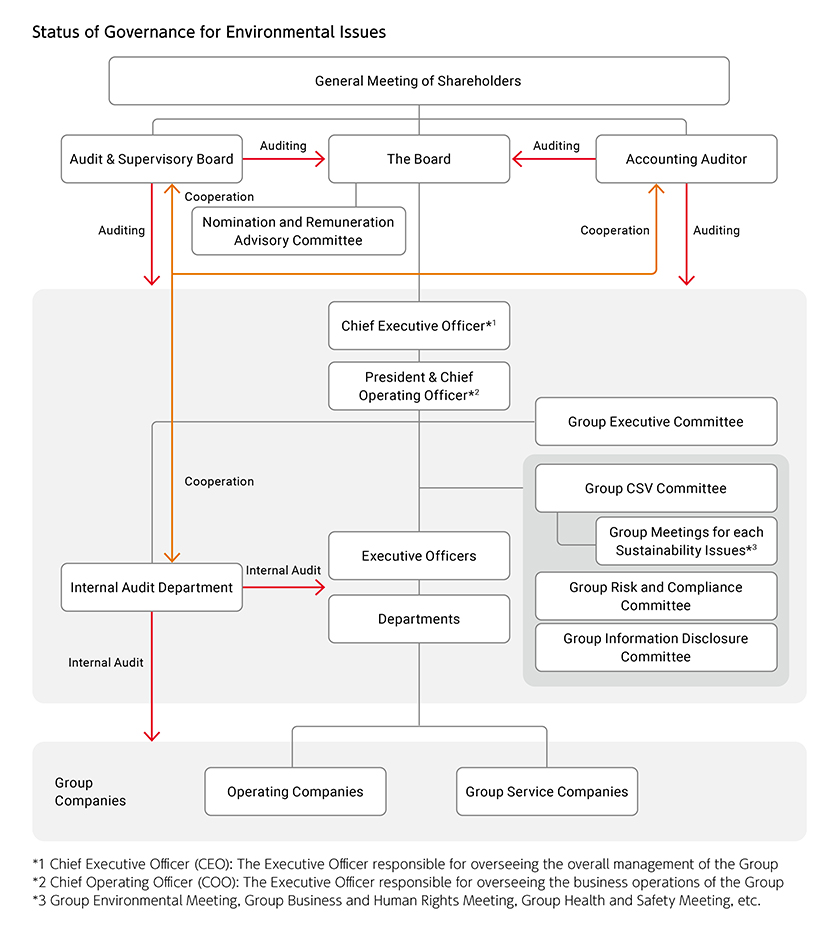

Governance

For more information on the supervisory and executive structures as follows.

-

Skill map of senior management is shown as follows.

https://www.kirinholdings.com/en/purpose/governance/provisions/

-

Refer to the following for information about the relationship between executive remuneration and non-financial indicators, which are one of the main management indicators in our Medium-Term Business Plan.

https://www.kirinholdings.com/en/purpose/governance/conpensation/

-

Our 2022-2024 CSV Commitments, which is incorporated into the management plans of the Kirin Group and operating companies, is shown below.

https://www.kirinholdings.com/en/sustainability/commitment_performance/2022/

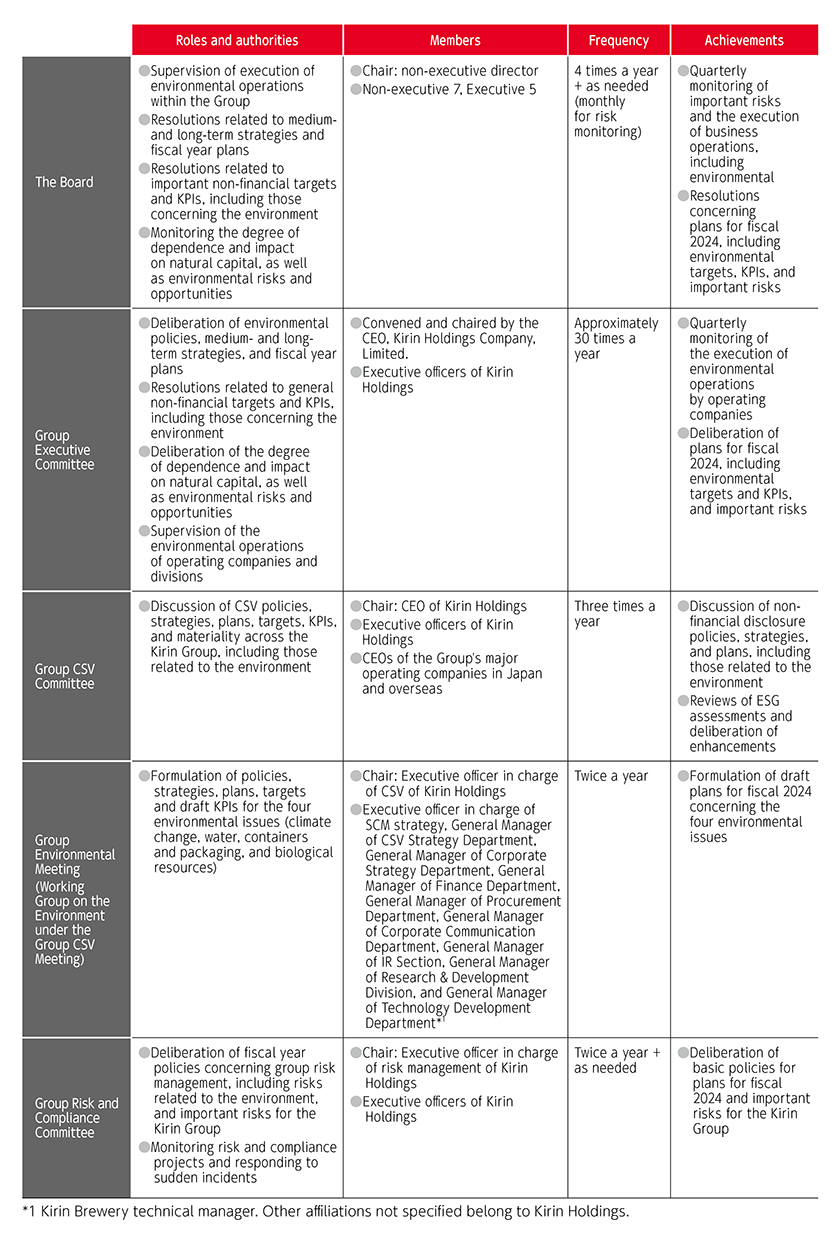

The supervisory and executive structures and their roles and responsibilities, members, frequency of meetings and performance are as follows.

Risk Management

In the section on governance, we have described our measures to address significant physical and transitional risks related to climate change detected in scenario analysis. Senior management deploys mitigation and adaptation strategies and manages targets under the supervision of the Board. The same applies to overall risks related to sustainability, including the degree of dependence and impact on natural capital and the creation of a circular economy.

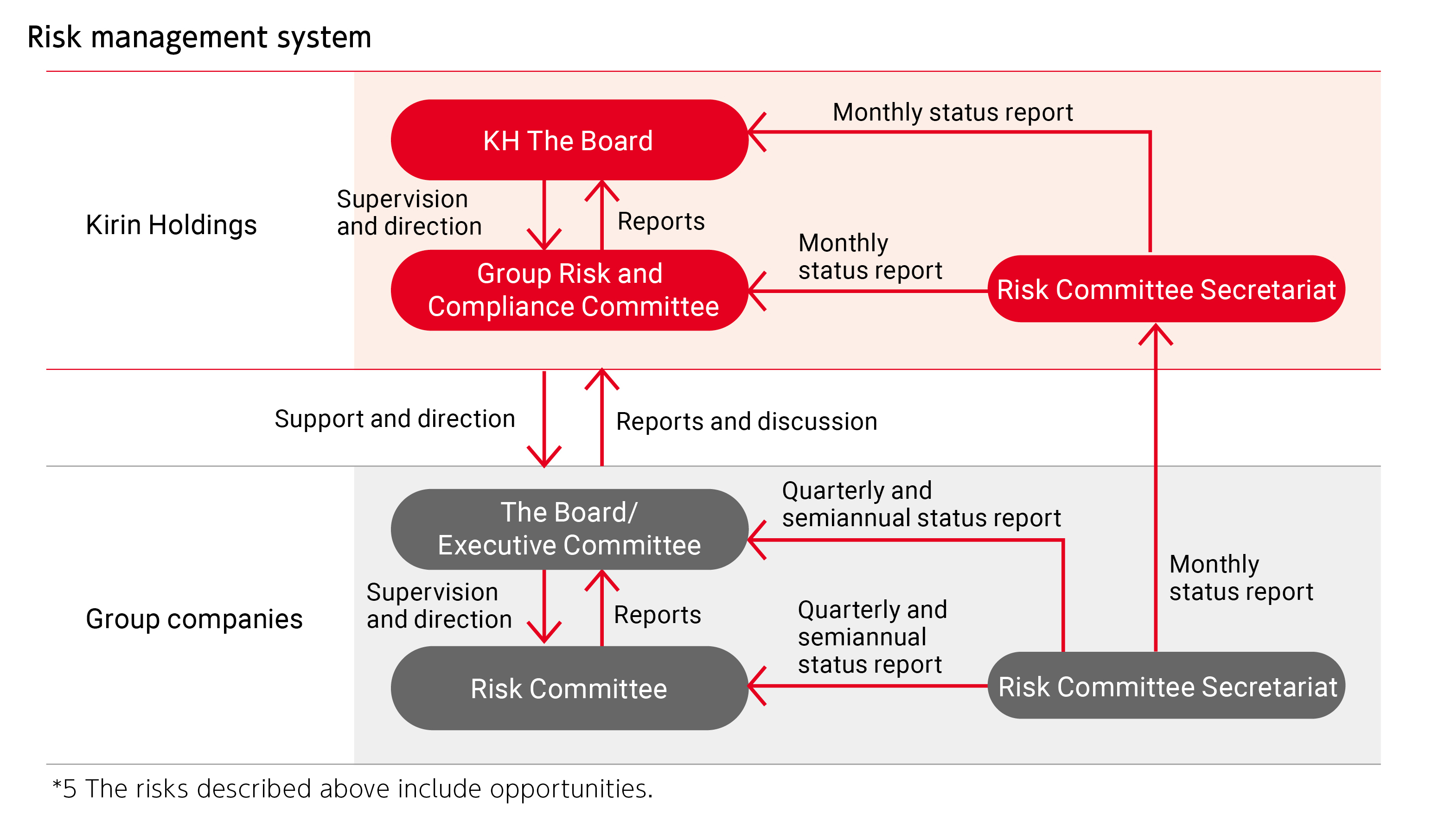

The risk management system and PDCA cycle are as follows.

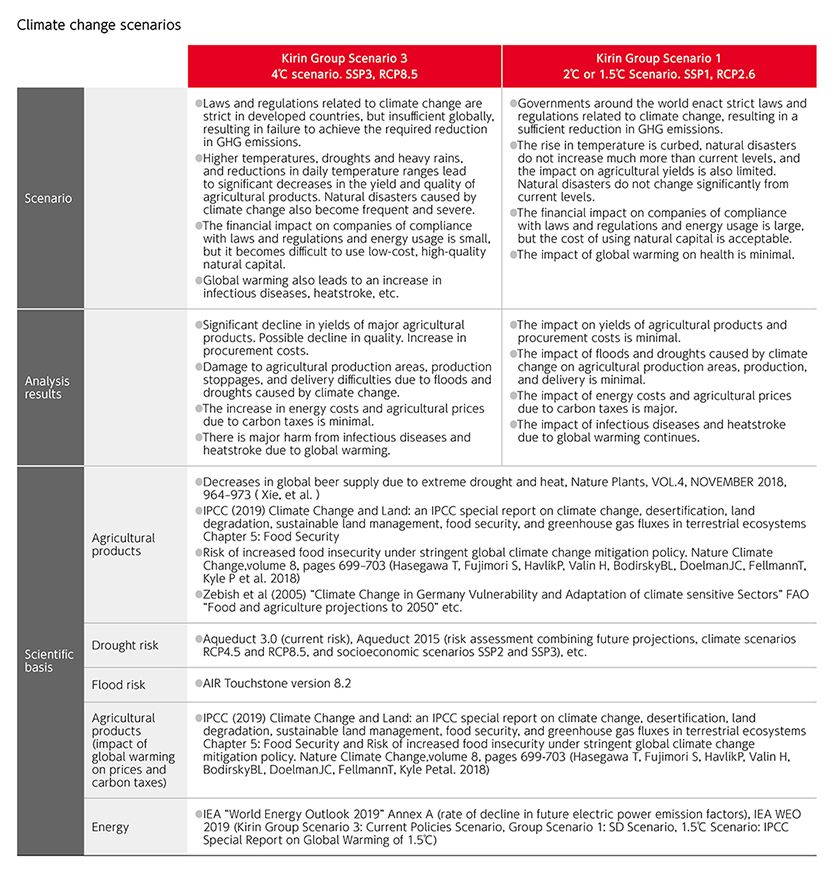

Strategy

The strategy part details financial impact assessments, scenario analysis for climate change, and resilience assessments of risks and opportunities related to natural capital.

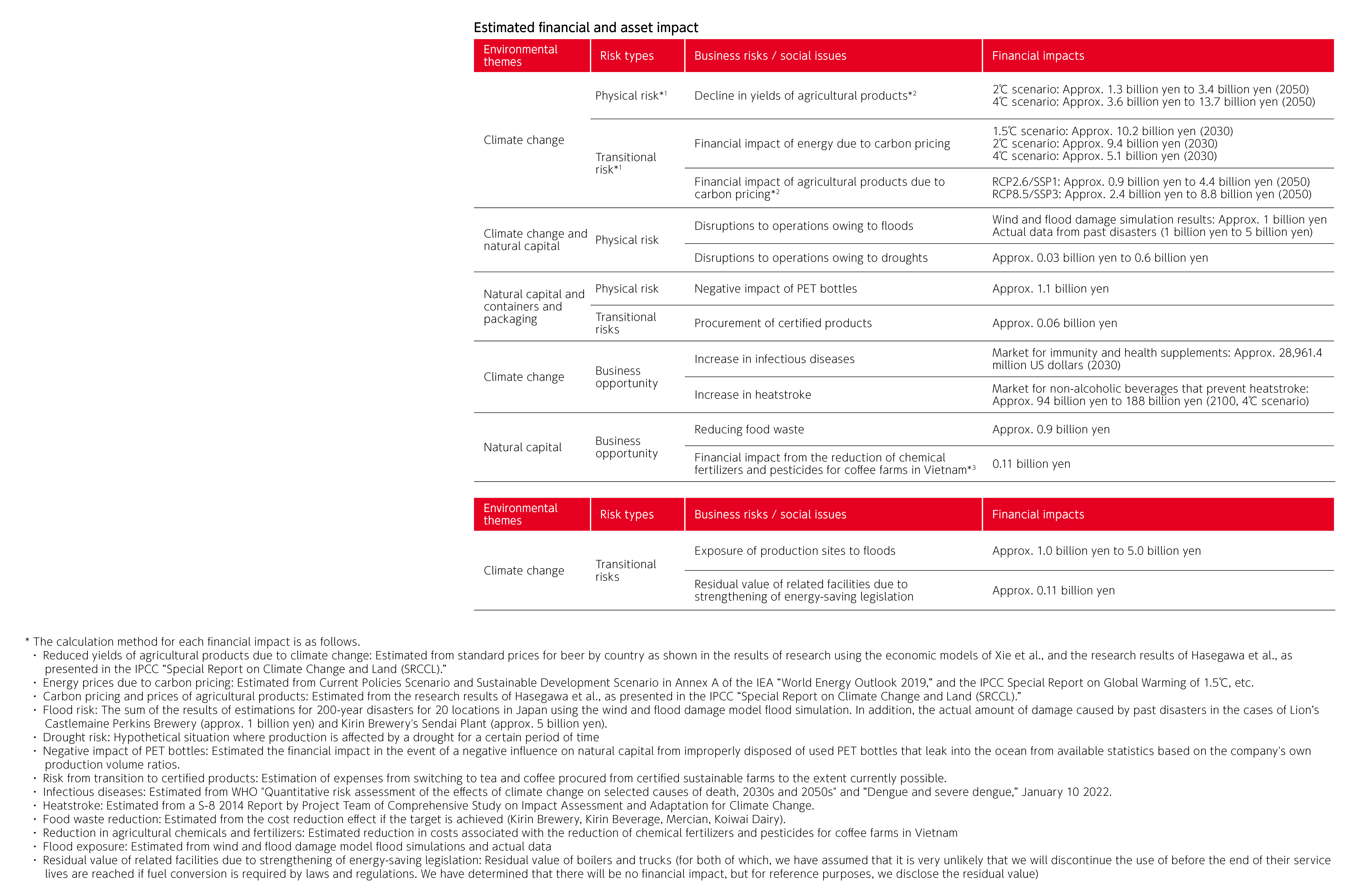

Results of financial impact assessment

The estimated impacts on finance are as follows.

We assessed the financial and asset impacts of climate change, natural capital, and containers and packaging. We have summarized the interrelated impacts of climate change, natural capital, and containers and packaging. We assume that it is unlikely that fuel for boilers and trucks will be replaced with hydrogen and electricity before the service life of equipment is reached as a result of laws and regulations. For reference, we disclose the “residual value of related facilities.” Estimates of the financial impact related to climate change and natural capital are limited, and we cannot determine risk from financial impact estimates alone. Accordingly, we have combined these estimates with qualitative analysis and assessments from scenario analysis for reflection in our strategies.

Financial impact

Resilience Assessment

For more information on climate change scenario analysis and resilience assessment, LEAP approach to natural capital risk and opportunity analysis, and natural capital scenario analysis, please see below.

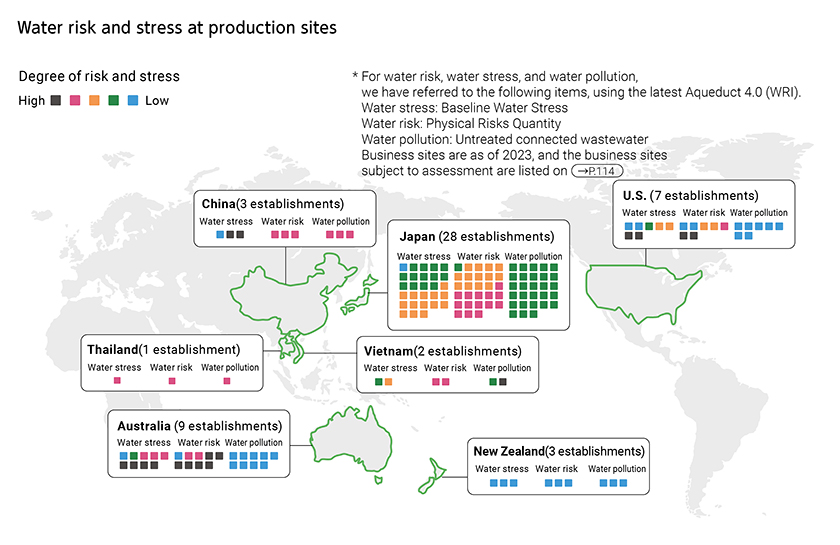

Water risk and stress at production sites

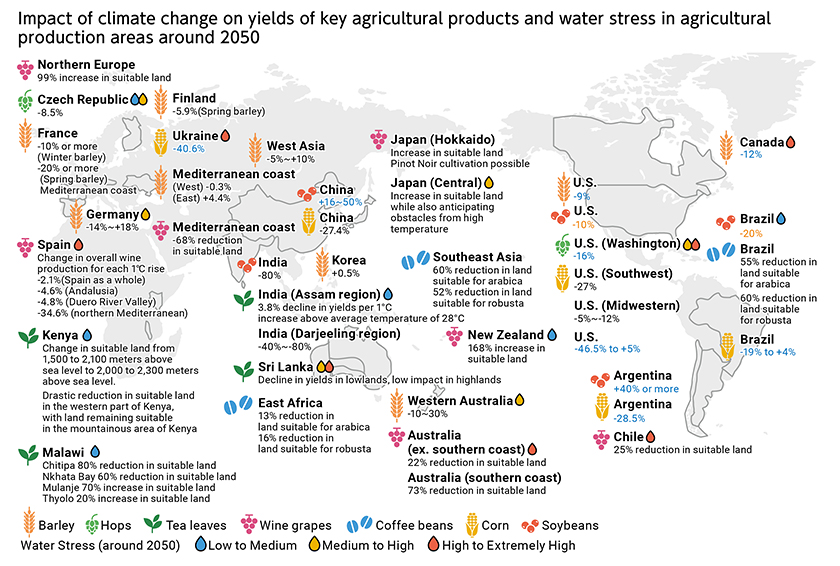

Impact of climate change on yields of key agricultural products (Forecast for 2050 unless otherwise specified)

Materiality analysis of natural capital

Based on v1.0 of the TNFD recommendations and the updated LEAP approach, the Kirin Group reassessed issues and assessments related to natural capital.In the scoping phase of the LEAP approach, we conducted a comprehensive assessment of the level of dependency and impact, and we are prioritizing coffee beans, hops, tea leaves, and soybeans as a result. We selected tea farms in Sri Lanka as a field where we can perform concrete activities, and analyzed and assessed risks and opportunities using the LEAP approach. The results show that Sri Lanka's natural capital is affected in various ways, not only by climate change, but also by economic development.The Kirin Group has identified that there is high possibility of reducing risks associated with natural capital in Sri Lanka by supporting the acquisition of certification, which we have been doing since 2013, and by implementing the “Regenerative Tea Scorecard (referred to below as the “Scorecard”)” in order to promote regenerative agriculture, which we began in 2023.The analysis and assessment procedures are as follows.

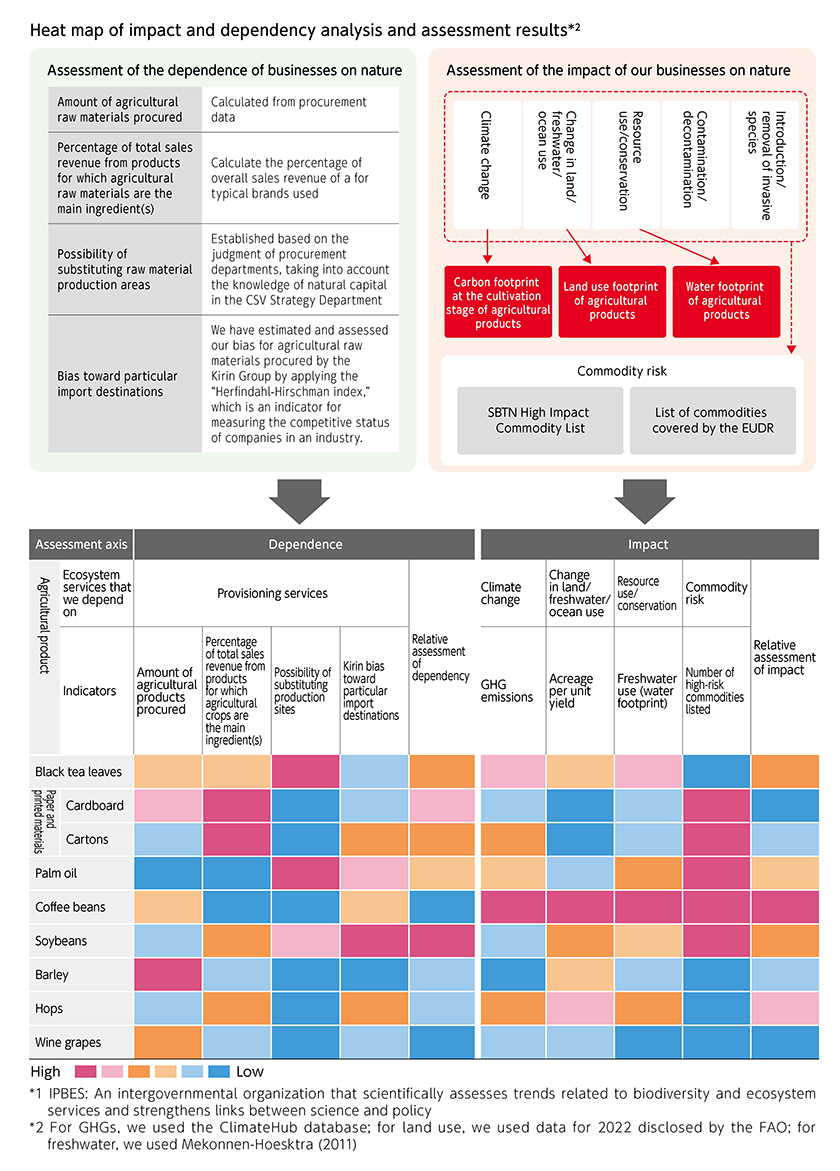

Scoping implementation

Based on an overview of the business domains and value chain of the Kirin Group as a whole, we have established the hypothesis that there is a high degree of dependence and impact on nature at the stage of procuring agricultural raw materials. For this reason, we analyzed and assessed "black tea leaves, paper/printed materials, palm oil, coffee beans, and soybeans" which are covered by the “Kirin Group Action Plan for Sustainable Use of Biological Resources,” as well as "barley, hops, and wine grapes," of which we procure large amounts, on the two axes of "impact of our businesses on nature" and "nature-related dependencies of our businesses." We then used the LEAP approach for scoping of the agricultural products to be analyzed in detail.For the “nature-related dependencies of our businesses,” in order to assess our dependence on “provisioning services” for agricultural raw materials, as indicated in the TNFD recommendations, we used the following original assessment indicators: “procurement volume,” “impact on Group sales revenue,” “possibility of substituting raw material production areas,” and “bias toward particular import destinations.”Concerning the “impact of our businesses on nature,” we assessed the following indicators: “carbon footprint at the cultivation stage,” “land use footprint,” and “water footprint,” for which data is available on a per-crop basis, and which are among the impact factors listed by IPBES*1 that the TNFD recommendations state should be considered. We also confirmed whether agricultural products are listed as high risk by the SBTN and the EuropeanRegulation on Deforestation Free Products (EUDR).

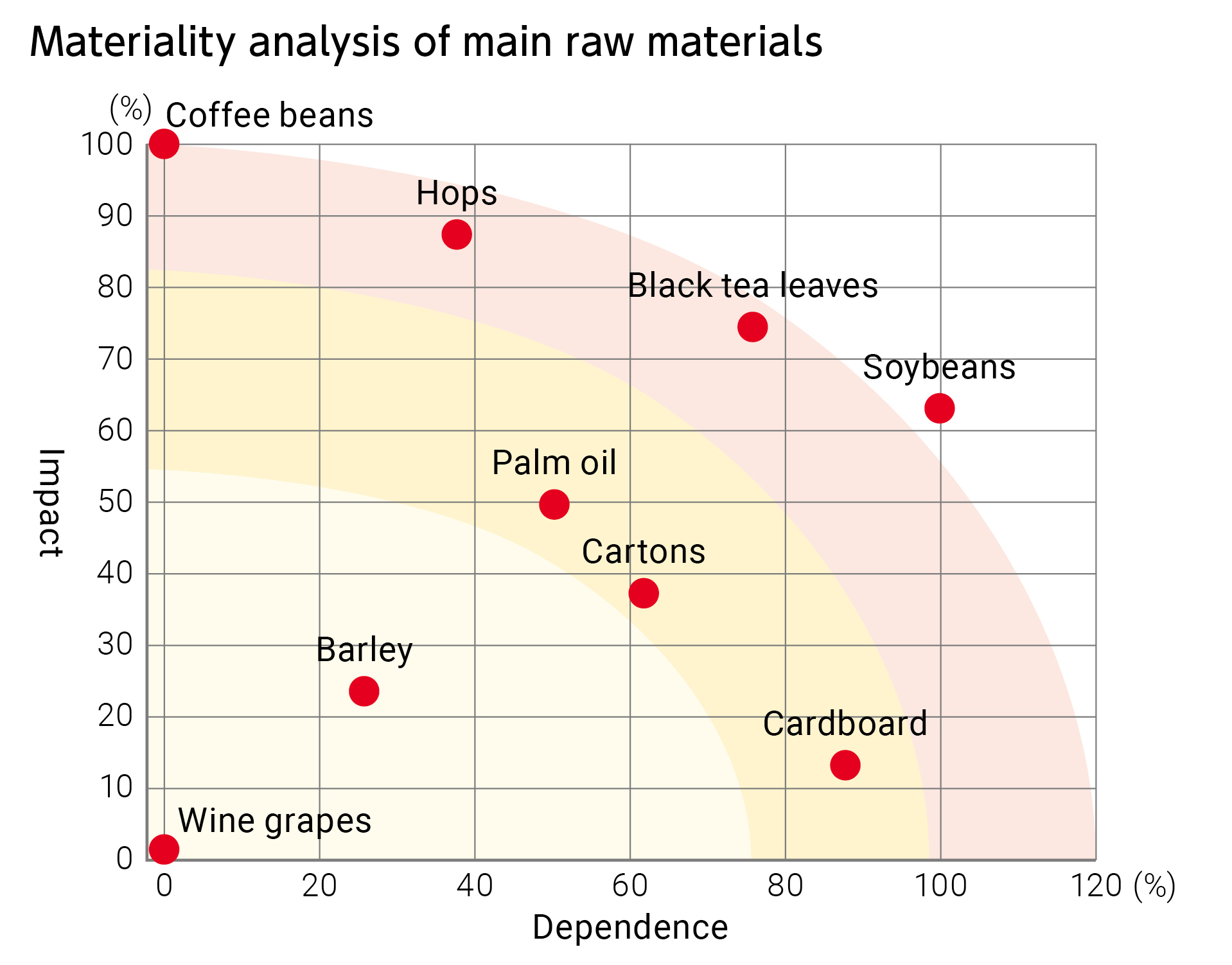

Materiality analysis and assessment results in scoping

We conducted analysis and assessment of the “impact of our businesses on nature" and the “nature-related dependencies of our businesses.” The horizontal axis indicates dependency, and the vertical axis indicates impact. Based on this “materiality analysis of main raw materials,” we are prioritizing four raw materials: coffee beans, hops, tea leaves, and soybeans. Although we have not yet fully considered some factors, such as the weighting of assessment items, we believe that the results are consistent with knowledge gained from our initiatives targeting natural capital over many years and are credible.

Analysis and assessment of risks and opportunities based on the LEAP approach

We analyzed and evaluated our dependence and impact, and risks and opportunities for tea leaves from Sri Lanka, which we have designated as a priority target and priority location in the scoping described in the preceding paragraph. For the Locate and Evaluate stages, we used data from when we conducted these processes and disclosed them in our environmental report in 2023.

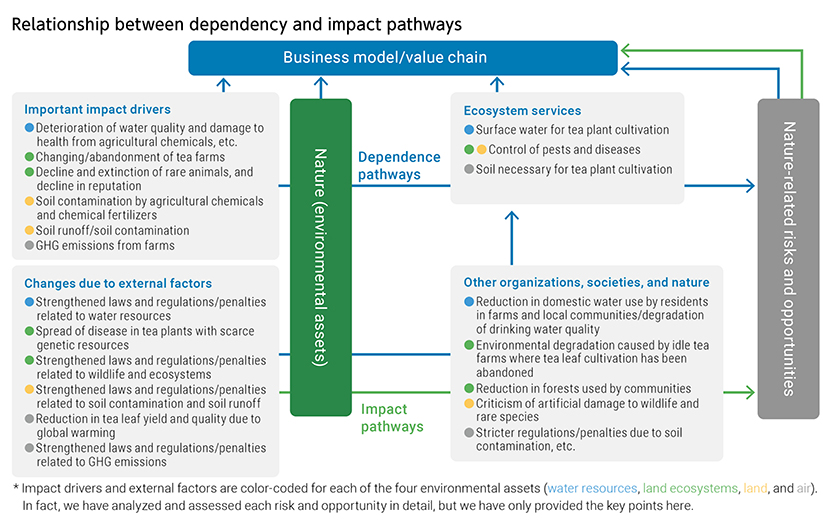

Assess (assess risks and opportunities)

Based on lists of important impact drivers and ecosystem services compiled during the Evaluate phase, we created a diagram showing the relationships between dependency and impact pathways for each of the four environmental assets: water resources, land ecosystems, land, and air. We also identified external factors and external stakeholders for each important natural capital and determined risks and opportunities.

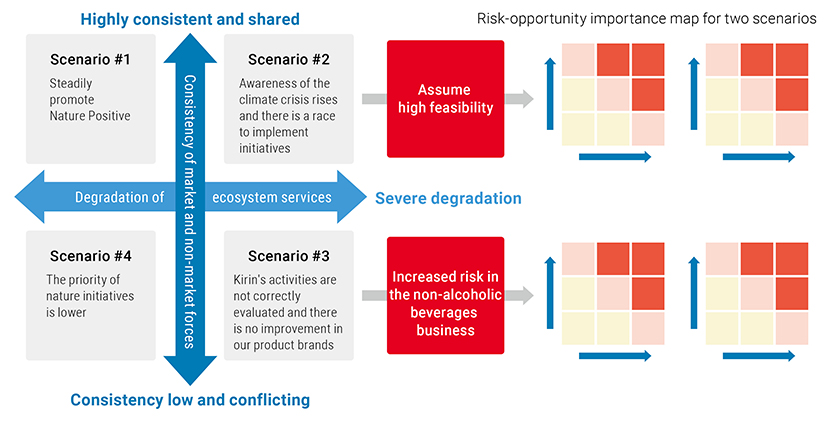

We then conducted scenario analysis. We put “ecosystem services” on the horizontal axis of the scenario, with the status quo level of natural capital on the right and the degradation of natural capital on the left. On the vertical axis, we put “market forces,” with the state of strict regulation and high awareness among consumers and investors at the top, and the state of loose regulation and low interest among consumers and investors on the bottom. Within this framework, we selected “nature degradation” scenarios #2 and #3 as the most realistic scenarios. Based on the risks and opportunities identified at the previous stage, as well as the magnitude of the financial impact, we created risk maps and conducted assessments.

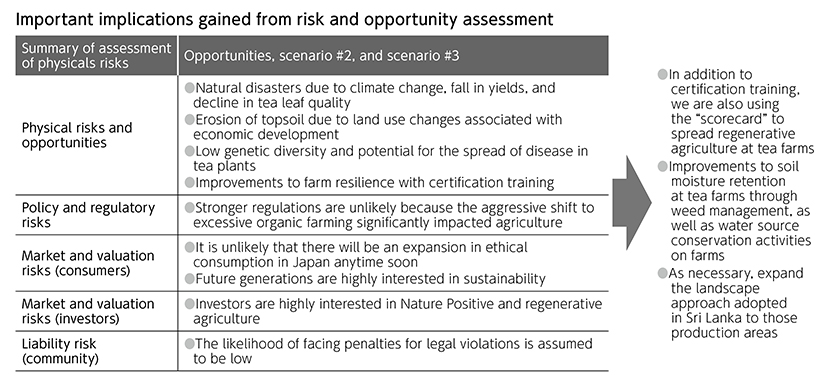

And based on the "important implications" obtained in this way, we have summarized our future directions (Prepare: preparing reports) as follows.

Future directions (Prepare: preparing reports)

In response to important implications gained from the Assess stage, we have summarized our future activities at Sri Lankan tea farms as follows. We plan to incorporate these activities into our medium- to long-term roadmap in the future.

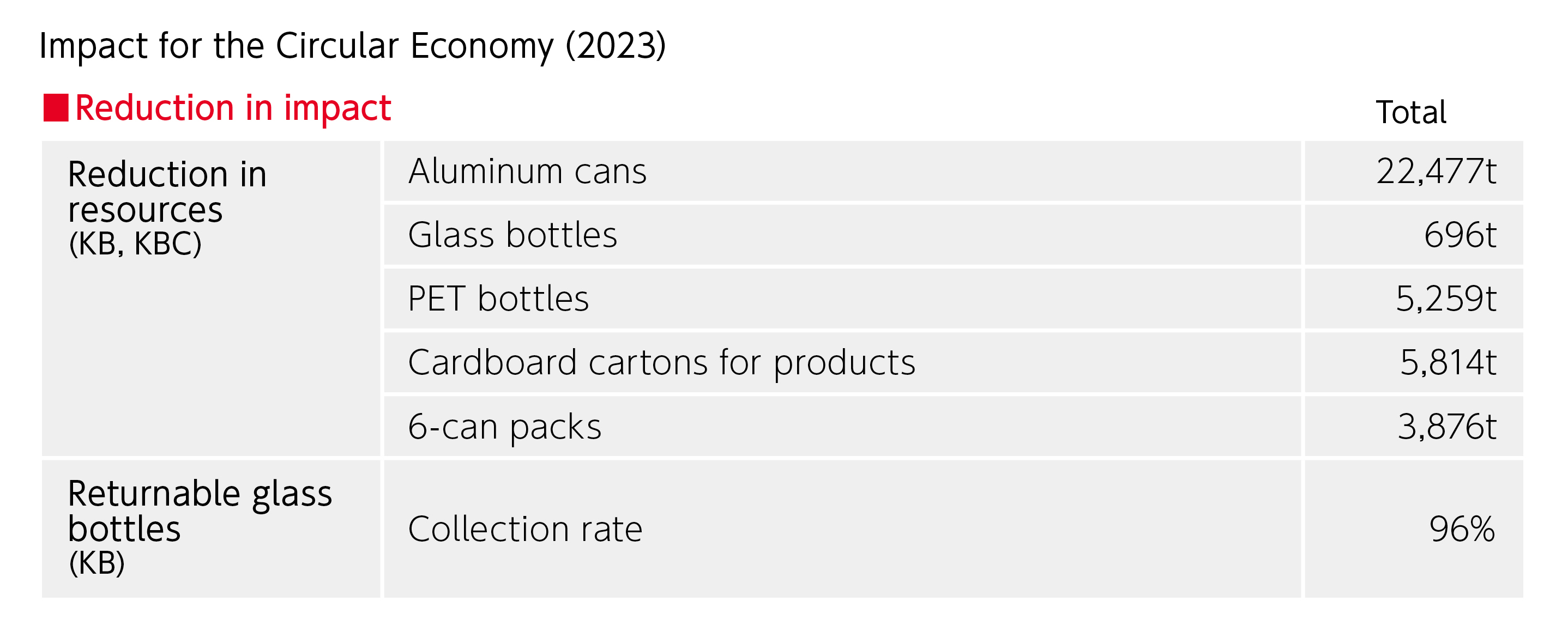

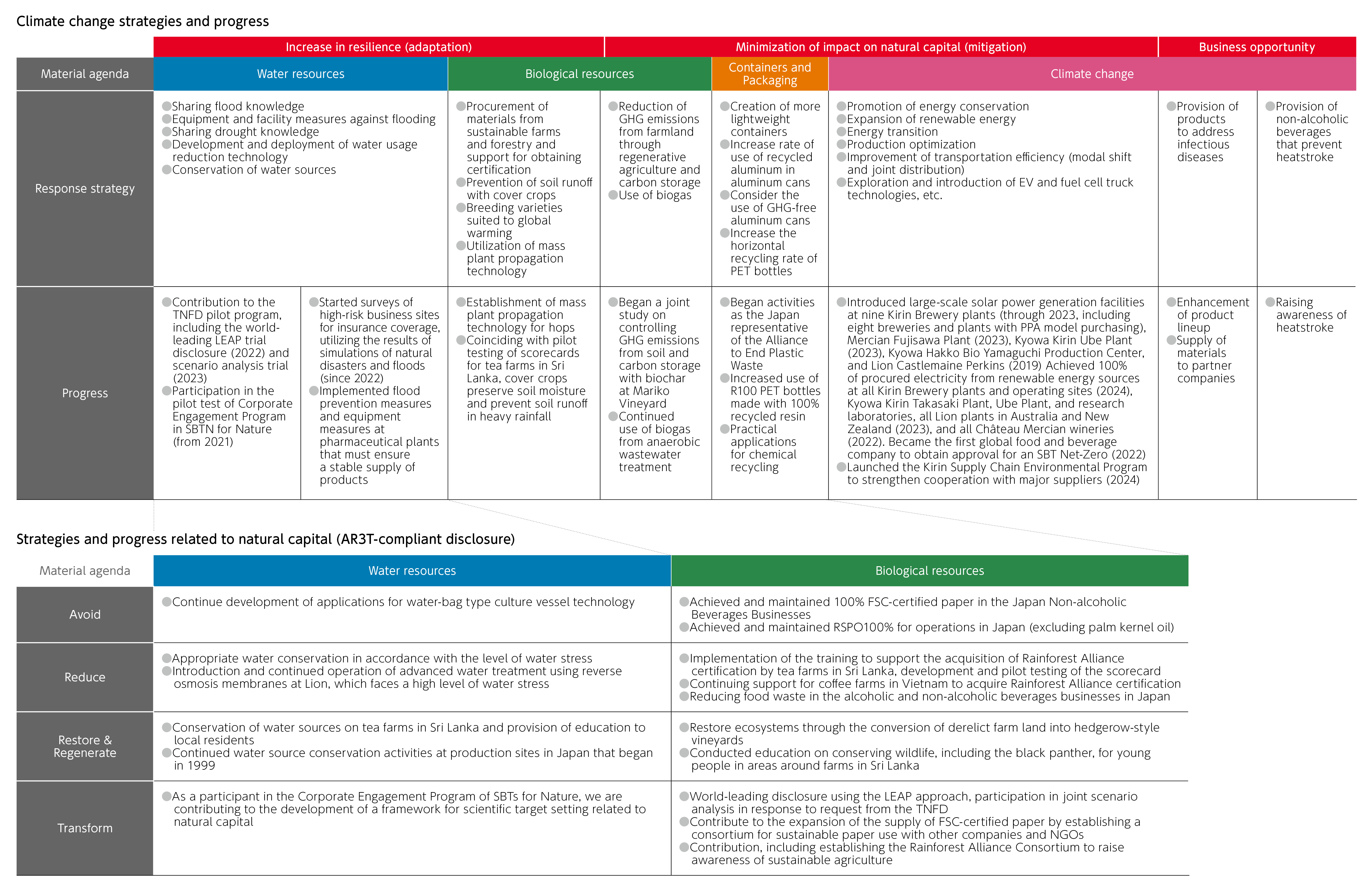

Approach to Environmental Issues

We have separately provided information concerning plans for transition to a decarbonized society, Nature Positive, and a circular economy, but in reality, we will implement these plans as a single unified plan that takes into account their interconnectedness. Our specific activities and their results for each of the aforementioned transition plans are shown below.

Our specific activities and their results in relation to natural capital, in accordance with the SBTN's AR3T framework, are summarized below.

Transition Plans

We have formulated holistic business transition plans which aim to simultaneously realize a decarbonized society, Nature Positive, and Circular Economy, ensuring business continuity. Our transition plans from the perspective of climate change mitigation and adaptation are shown as below.

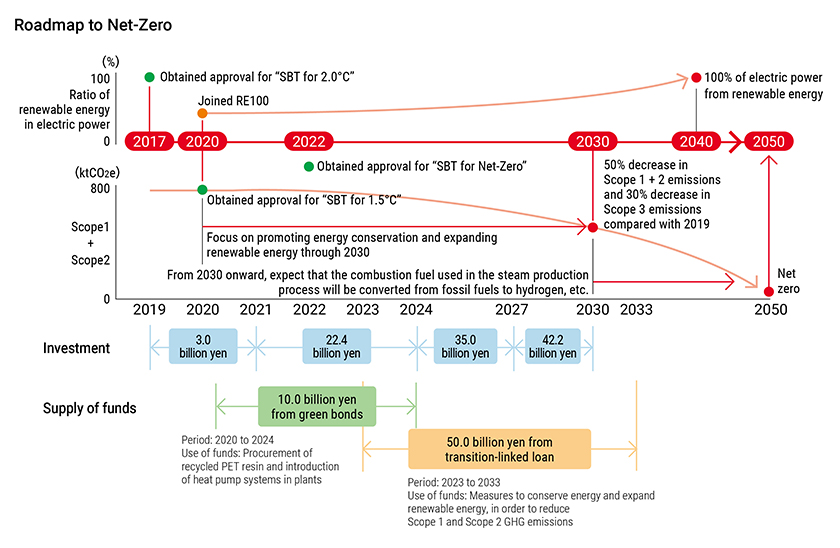

Plan to transition to a decarbonized society

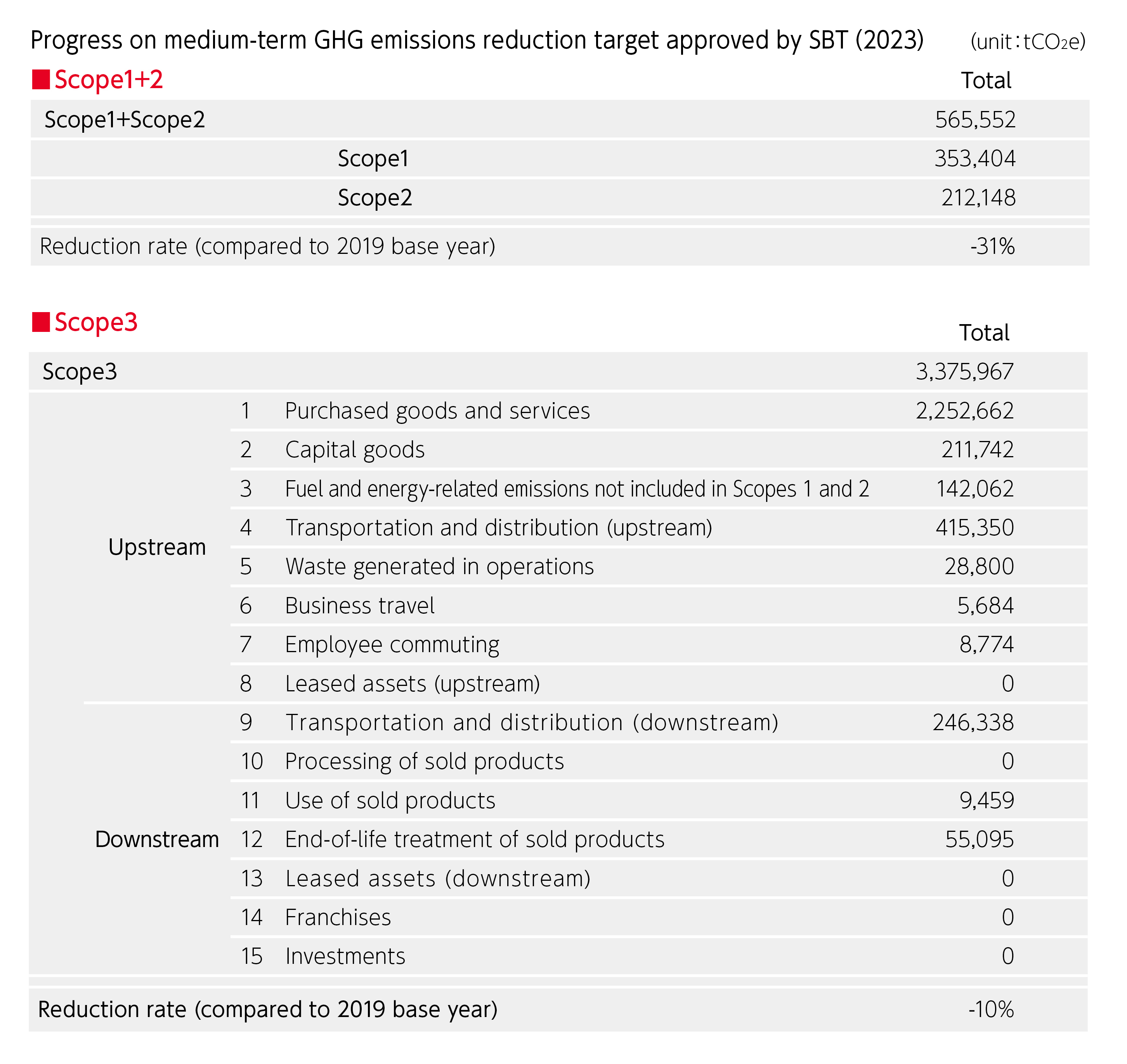

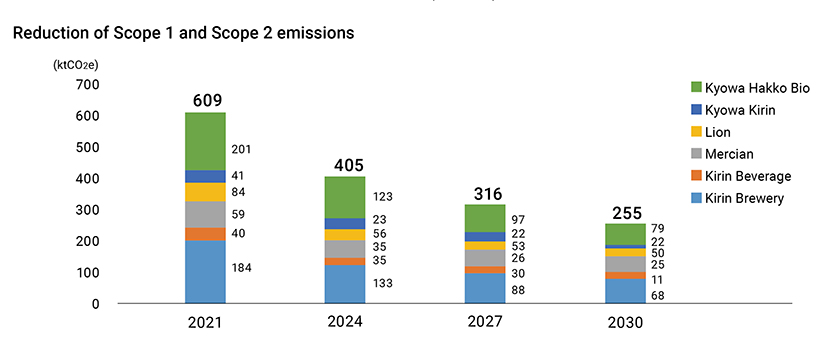

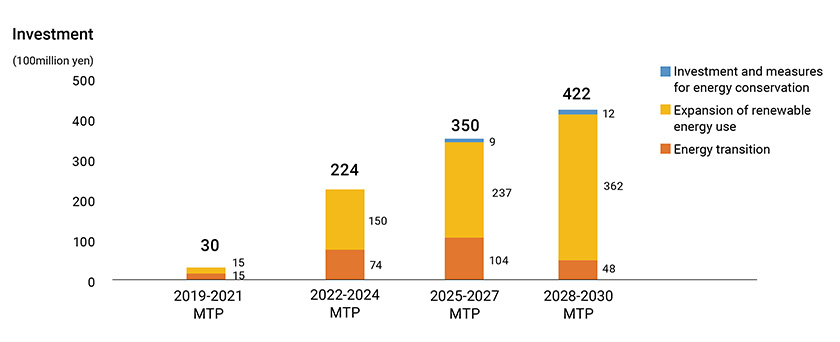

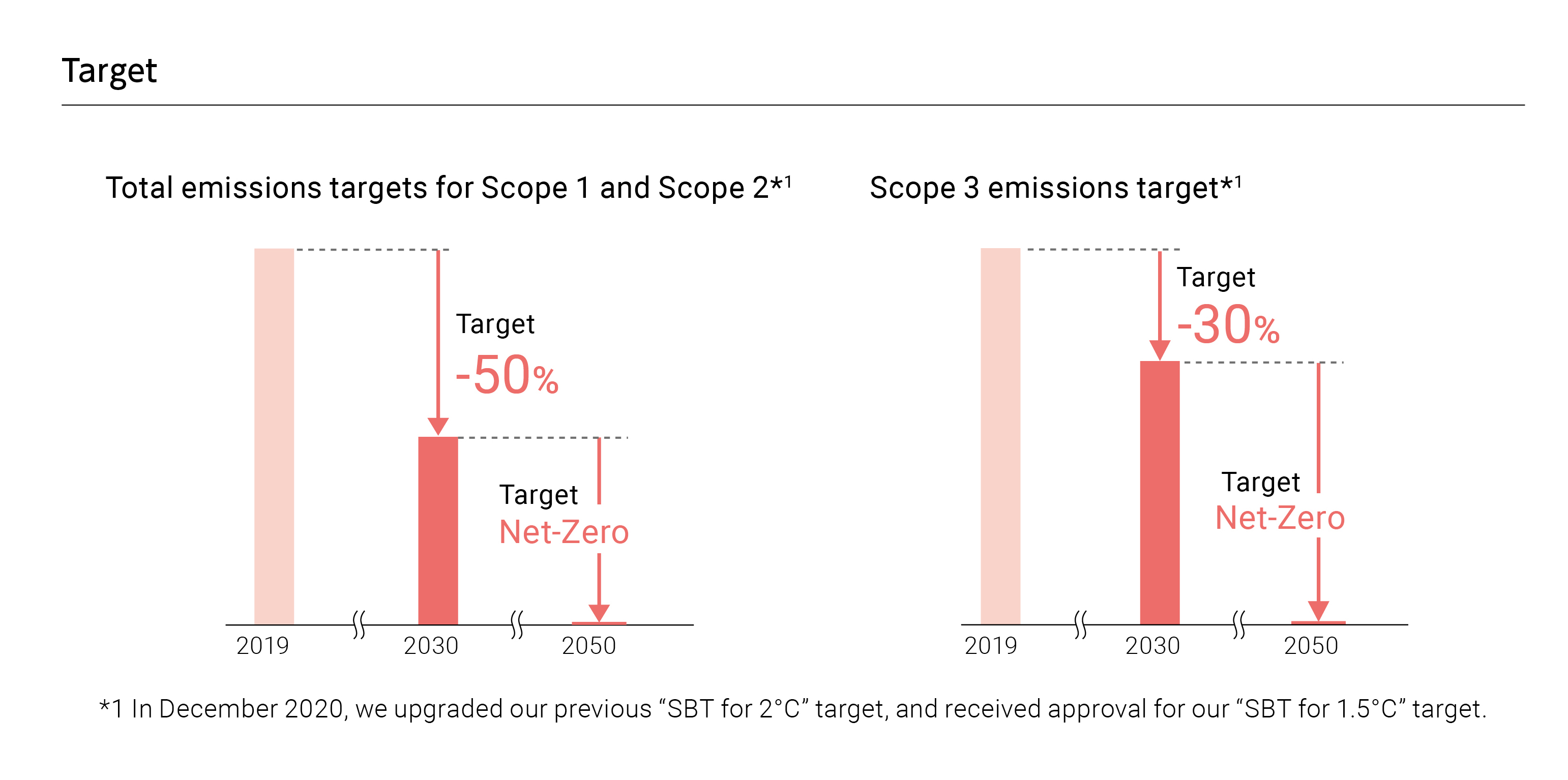

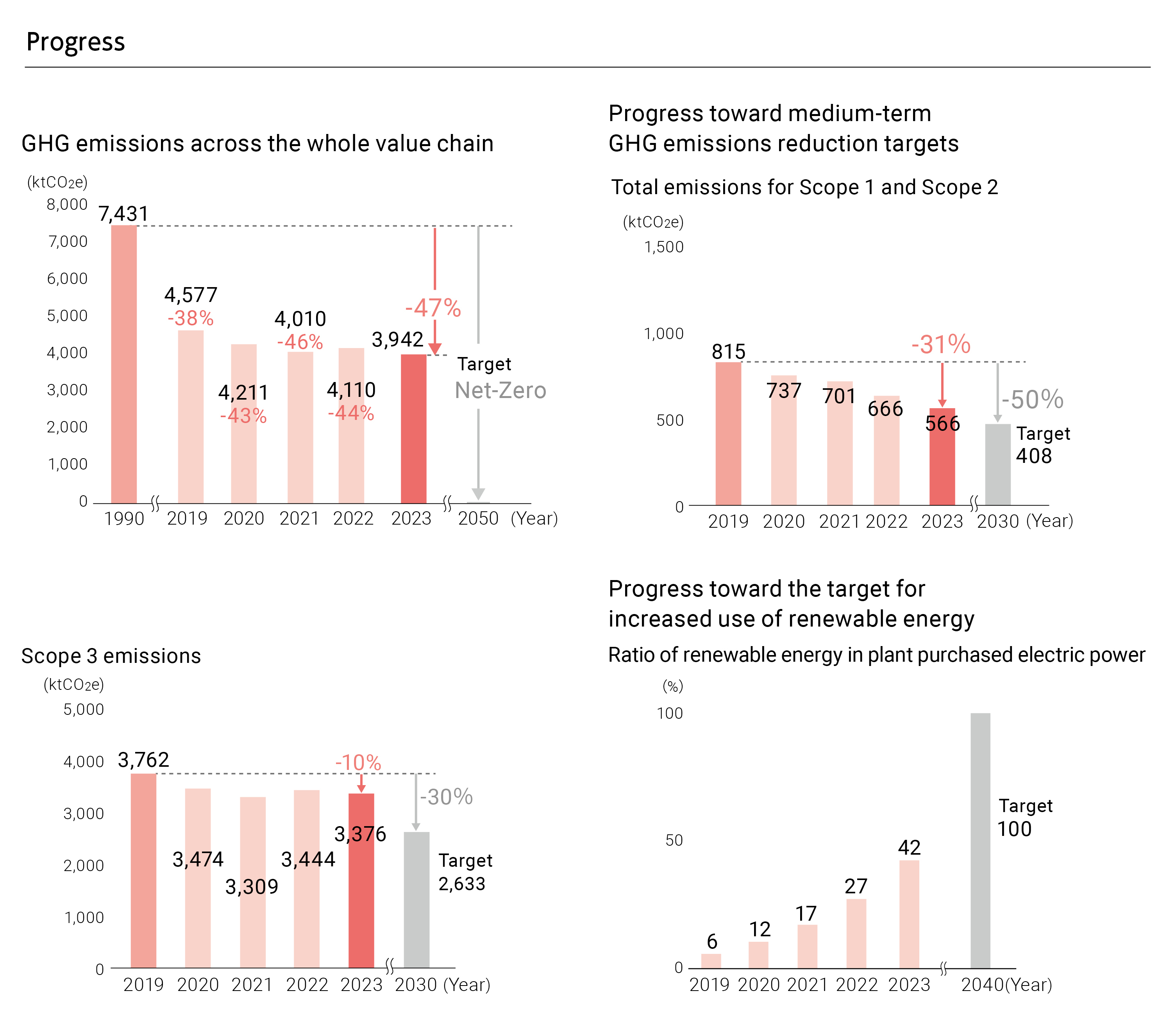

The roadmap to net zero, reduction of Scope1 and Scope2 emissions, and the investment are as follows.

The details of the transition plans for natural capital and containers and packaging can be found in the Environmental Plan 2024.

Metrics and Targets

For more information on metrics and targets, see as follows.

Metrics and Targets

Metrics